Tips to insurance for entering the insurance world as a newcomer can be daunting. It’s a complex realm with intricate terms, diverse premiums, and countless options. However, securing the correct insurance is vital for financial security. In this guide, we offer practical advice for first-time buyers.

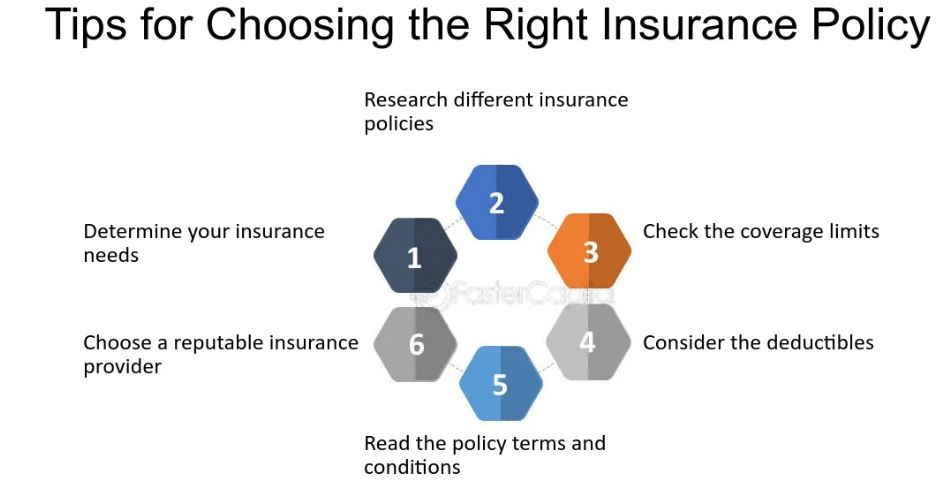

Tips to Insurance for choose the best insurance plan

Assess Your Unique Needs:

Before delving into insurance specifics, pause to assess your needs. Life’s different phases demand varying coverage types. Whether it’s auto, health, home, or life insurance, knowing your requirements is fundamental through tips to insurance. For example, if you’ve bought a car, prioritize auto insurance; if renting, consider renters’ insurance. This ensures you neither overspend nor leave vital areas uncovered.

Research and Comparison:

In the digital era, researching and comparing insurance is convenient. Begin by exploring online resources and using comparison tools. They provide multiple quotes, revealing competitive rates and fitting coverage. However, remember that the lowest cost doesn’t always mean the best choice. Evaluate the insurer’s reputation and the comprehensiveness of their coverage.

Seek Guidance from Experts:

Understanding insurance intricacies can be overwhelming. If you’re feeling lost, seek help from a licensed insurance agent or broker. They’re experts with in-depth knowledge of insurance products and can simplify policy complexities. Working closely with you, they’ll customize coverage to match your unique needs, ensuring you’re not overpaying for unnecessary features while still getting the essential protection you need.

Maximize Savings through Bundling:

One effective way to reduce your insurance costs is by bundling multiple policies with the same insurer. For instance, combining your auto and home insurance with one provider often leads to substantial discounts. This not only saves you money but also simplifies your insurance management. However, it’s crucial to compare the bundled price with the total cost of individual policies to ensure that you’re genuinely benefiting from the discount.

Set a Realistic Budget:

Creating a realistic insurance budget is crucial, tailored to your financial capability. Choosing minimal coverage might seem cost-effective but can lead to vulnerability during claims. Find the right balance between affordability and sufficient coverage, recognizing that insurance safeguards your financial security. Ensure prompt premium payments to prevent expensive coverage gaps over time.

Understand Deductibles and Premiums:

Understanding deductibles and premiums is vital. Your deductible is the amount you must pay before insurance kicks in. Higher deductibles usually mean lower premiums but more out-of-pocket costs during claims. Choose wisely, considering your finances and risk tolerance. Opting for a higher deductible can save you substantially on premiums in the long run if you can comfortably manage it.

Explore Available Discounts:

Insurance companies often offer a range of discounts that can help reduce your premiums. These discounts may be based on factors such as safe driving records, policy bundling, strong credit scores, or affiliations with specific organizations. For example, if you have a clean driving record, inquire about a safe driver discount on your auto insurance. Be proactive in seeking out available discounts, as they can add up to significant savings over time.

Regularly Review Your Policies:

Your insurance needs can change over time due to life’s evolving circumstances. It’s essential to conduct periodic reviews of your insurance policies to ensure they remain aligned with your current situation. Life events such as marriage, parenthood, vehicle purchases, or changes in your residence can all impact your insurance requirements. An annual policy review with your agent or insurer will help you make necessary adjustments, ensuring that you’re continually well-protected.

Master the Details of Your Policy:

Don’t rush through your insurance policy documents. Invest time in comprehending coverage limits, exclusions, endorsements, and riders. A clear grasp of what your policy includes and excludes is vital to avoid surprises during claims.

Prioritize Health and Safety:

For health and life insurance, your personal habits and health status can significantly impact your premiums. Leading a healthy lifestyle, quitting smoking, and maintaining a strong credit score can lead to lower insurance costs. Additionally, taking safety measures, such as installing smoke detectors or security systems or practicing safe driving habits, not only enhances your safety but also reduces your insurance expenses.

Conclusion

Tips to Insurance Navigating the complex world of insurance as a first-time buyer may initially seem challenging. However, armed with these valuable insights, you can approach the process with confidence. Remember to assess your unique needs, conduct thorough research, seek expert advice, and explore potential discounts. Regularly reviewing your policies and maintaining good health and safety practices can further enhance your insurance experience. By following these guidelines, you’ll not only safeguard your assets but also optimize your insurance coverage, ensuring peace of mind in the face of life’s uncertainties.

FAQs

- What’s the first tip for buying the right insurance?

Check prices from several insurance providers—this way you won’t pay more for identical protection. - How much coverage should I choose?

Pick protection that fits your money risks—something strong enough to swap out valuables and handle debts, yet keep earnings safe. - Why is reviewing policies yearly important?

Big shifts—like work, moving, or illness—can leave your current plan behind, causing holes in coverage or paying more than needed because things no longer fit how you live now, even if it once worked just fine back then when circumstances were different. - How can I lower my insurance premiums?

Raise your deductible, combine insurance plans while keeping solid credit – and skip tiny claims altogether. - What’s the biggest mistake people make with insurance?

Picking the lowest-cost option while skipping details on what’s not covered, how much is capped, or help during claims.