Telehealth Insurance Reimbursement Guide changed how people get health help—now it’s easier, cheaper, and lighter to reach. Instead of going in person, folks hop on calls for checkups, talk therapy, or handling long-term issues. Millions across the U.S. use these online options just like regular doctor trips.

Yet a big doubt remains—will insurers pay for online medical visits?

Folks need to know how telehealth billing works if they want to use their health coverage well—this matters whether you’re a patient or a provider. Different rules apply depending on your plan, so checking details ahead helps avoid surprises later. Some services pay more online than others, which affects what options make sense financially. Knowing this stuff early means smarter choices when booking virtual visits. This full walkthrough explains coverage rules—digging into payment setups, perks, and what’s not included, along with top recurring queries—to make telehealth easier to handle in 2026.

What Is Telehealth Insurance Reimbursement?

Telehealth insurance reimbursement refers to how insurers cover online doctor visits. It covers things like

- Video doctor visits

- Phone consultations

- Online therapy sessions

- Remote patient monitoring

- Digital scripts plus online check-ins

Thanks to the ACA, lots of insurers now pay for telehealth just like office visits—this became more common once rules changed during and following the pandemic.

Still, payment terms change depending on:

- Insurance company

- State regulations

- Type of healthcare offered

- Provider qualifications

Types of Telehealth Services Covered by Insurance

1. Virtual Primary Care

Routine checkups—also follow-up visits—for ongoing health issues or just everyday worries.

2. Teletherapy & Behavioral Health

Online therapy talks, mood check-ins by pros, and also full mental health reviews.

3. Specialist Teleconsultations

Heart doctors, skin specialists, and hormone experts—along with various expert check-ups.

4. Remote Patient Monitoring (RPM)

Checking blood pressure with gadgets, while tracking sugar through tech tools, and also watching heartbeat patterns via electronic gear, alongside measuring oxygen with a device.

5. Urgent Care Services

Quick check-ups for small cuts, bugs, spots on skin, or things like fever outta nowhere.

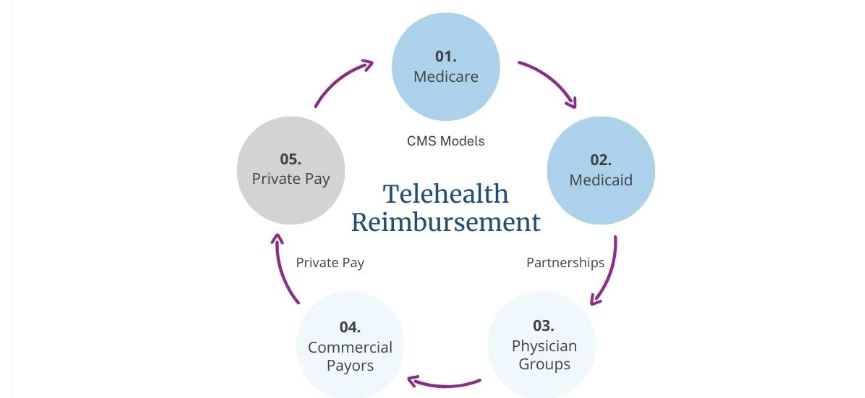

How Telehealth Insurance Reimbursement Works

1. Copays & Coinsurance

Many insurance options set identical fees for virtual checkups compared to office visits. A few cover online sessions without any out-of-pocket cost.

2. Deductibles

If you’re on a high-deductible setup, coverage might only kick in after hitting that deductible.

3. In-Network vs. Out-of-Network

With in-network doctors, telehealth payback tends to be better.

4. Documentation Requirements

Providers must submit:

- Diagnostic codes

- Procedure codes

- Telehealth-specific modifiers

- Patient consent records

5. Payment Parity Laws

Some places today insist on equal pay—telemedicine appointments get covered just like face-to-face ones.

Pros & Cons of Telehealth Insurance Reimbursement

Pros

1. Lower Healthcare Costs

Telehealth usually cuts down on travel costs and also saves hours from your job schedule while skipping clinic visit charges altogether.

2. Increased Accessibility

Rural folks and people with disabilities—also older adults—get better access to medical help.

3. Convenience for Patients & Providers

With adjustable timing plus quicker check-ups, you get things done without delays while making better use of your day.

4. Expanded Coverage

Many insurance plans cover online therapy, ongoing health issues, or trips to specialists.

5. Encourages Preventive Care

Patients often reach out sooner if they can connect online instead of waiting.

Cons

1. Coverage Varies

Every insurance plan pays differently for online health visits.

2. Technology Limitations

Poor web connection or old gadgets could mess up how things run—so performance might drop if tech isn’t up to speed.

3. Out-of-Network Costs

Going with out-of-network care might mean you get paid back less.

4. Privacy Concerns

Telehealth needs tools that follow HIPAA rules; yet, certain doctors might skip encrypted options.

5. Inconsistent State Laws

Rules about online healthcare differ a lot depending on where you are in the country.

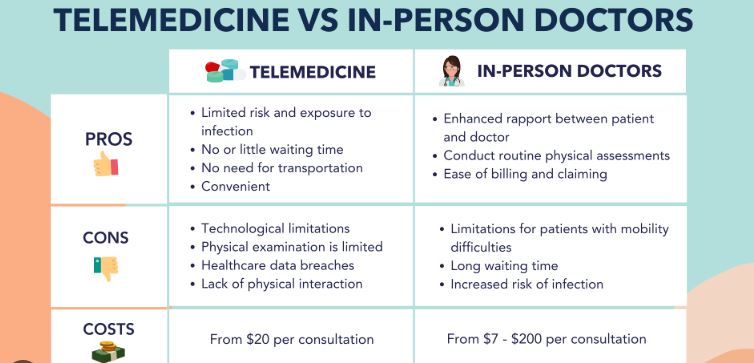

Telehealth vs. In-Person Reimbursement: What’s the Difference?

Many insurance policies today pay about the same for either kind of appointment, so one isn’t favored over the other.

Still, a few gaps might stick around

Certain steps might need face-to-face checks

Some insurance plans might skip coverage for calls made just through phones

Fees for expert help could be paid back another way. Telehealth is now seen as normal for plenty of treatments.

Conclusion

Telehealth payouts from insurers keep changing, yet they’re still a big leap forward in today’s medicine. By 2026, nearly every key insurance provider will cover online visits just like face-to-face ones, so more people can get care without breaking the bank.

Even though refund amounts might change based on where you live or who covers your insurance, knowing how your policy deals with virtual visits could mean lower costs while letting you see a doctor fast. Remote care isn’t going away—pick a solid plan, and it’ll make life easier and lead to better health results.

FAQs

1. Does health insurance reimburse telehealth services?

Answer: Yep. Big insurers usually cover online visits just like face-to-face ones—though it depends on your specific plan and where you live.

2. Do I need special approval for a telehealth visit?

Answer: Most times it’s a no. Still, certain options need approval before you use virtual visits or at-home tracking tools.

3. Are teletherapy sessions covered by insurance?

Answer: Yep. Teletherapy tends to be a commonly included service through both ACA and job-based health coverage.

4. Does Medicare reimburse telehealth visits?

Answer: Yep. Medicare now pays more for online visits—especially therapy sessions, ongoing condition tracking, or devices that check your health from afar.

5. Are telehealth visits cheaper than in-person visits?

Answer: In most situations, sure. Certain options give smaller fees—or sometimes no fee at all—when you see a doctor online, particularly for general checkups or counseling sessions.