Supplemental Dental Vision and Hearing Coverage. With healthcare costs rising, many people in the U.S. now choose additional dental, vision, or hearing plans—since regular insurance doesn’t cover everything. These side policies protect your wallet for checkups, specialized therapies, or sudden medical needs that most basic plans skip. If you’re retired and on Medicare, working solo, or supporting loved ones who need stronger care options, extra coverage keeps your health steady without draining cash.

In this full walkthrough, you’ll learn what extra dental, eyesight, or hearing options cover—and also when they’re useful. We’ll show what sets them apart while helping you pick solid protection that fits your life come 2026.

What Is Supplemental Dental Vision and Hearing Coverage?

A little extra insurance can help pay for things your regular plan doesn’t cover well. It’s not required; it’s just a choice some people make. You usually get it from private companies, not the government. This kind of policy might chip in for costs like prescriptions or check-ups

1. Dental Coverage

- Cleanings and exams

- Fillings, extractions, and X-rays

- Braces—depends on your coverage

- Crowns or false teeth—root treatments too

2. Vision Coverage

- Eye exams

- Prescription glasses

- Contact lenses

- LASIK discounts

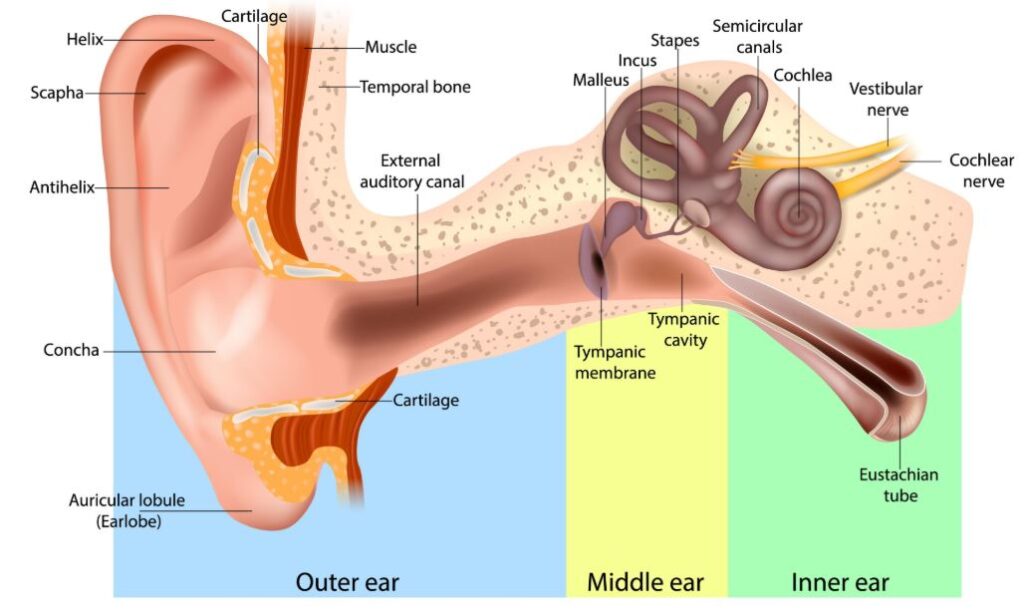

3. Hearing Coverage

- Hearing tests

- Hearing aids

- Tool parts plus tweaks

- Assistive technology upgrades

Extra coverage helps pay bills, opening doors to key health needs—perfect for older folks, kids, or grown-ups needing regular dental, eye, or ear care.

Why Supplemental Coverage Matters in 2026

Most basic health plans—like Medicare—don’t cover dental, vision, and hearing care fully. Because of this, folks usually end up paying steep costs on their own

- $80–$150 for routine dental cleaning

- $300–$1,500 for glasses

- $2,000–$6,000 for hearing aids

Extra protection can lower expenses, also encouraging timely check-ups plus healthier living.

Pros & Cons of Supplemental Dental Vision and Hearing Coverage

Pros

1. Affordable Preventive Care

Regular visits catch problems early—so extra coverage saves cash down the road.

2. Lower Out-of-Pocket Costs

Coverage cuts costs on treatments, tools, or check-ups.

3. Supports Overall Health

Problems with teeth often tie into long-term illness. Trouble seeing? That’s connected too. Hearing fades alongside certain conditions. Getting help fast makes days better. Quick action changes how you feel daily.

4. Ideal for Seniors & Families

Those plans work well for folks needing regular treatment.

5. Flexible Options

Go for separate dental, vision, or hearing coverage – or mix two, save more. Pick one plan, skip the rest. Bundle all three, pay less overall.

Cons

1. Coverage Limits

Some plans set a limit on yearly coverage—this often hits services like advanced dental work.

2. Waiting Periods

Big treatments such as crowns or false teeth might require you to wait from half a year to over a year.

3. Not All Providers Accept Supplemental Insurance

You might not pick just any dentist, optometrist, or hearing specialist due to network limits.

4. Premium Costs VaryBundled deals might be pricier based on how old you are – where you live also plays a role, while the extras you pick change the price too.

How to Choose the Best Supplemental Plan in 2026

To score top deals, weigh up these key points:

Figure out what you actually need

Need a dentist now and then? How about regular vision tests—maybe new hearing aids every few years? Tying perks to your habits can save cash down the road.

Check out different plans. Also, look at their networks

See if your go-to dentist or eye doc is covered by your plan. Going outside could mean steeper bills.

Check how much coverage is offered

Pick a plan that covers more per year when you need big dental jobs – or top-tier hearing devices.

Check how long you must wait before getting coverage

If you need care fast, pick options that start right away.

Look into package deals. Bundling dental, vision, or hearing care could lower costs while making perks easier to manage

Conclusion

Supplemental dental vision & hearing coverage is basic insurance; extra help for teeth, eyes, and ears matters more now—health prices keep going up. If you’re older, self-employed, raising kids, or stuck in an office job, these extras save money without skimping on good treatment. Pick the right add-on plan, and stay on top of your smile, sight, and sound—hearing clearly, seeing sharply, feeling confident—all day, every day. Picking a good plan means knowing what you need, looking at different companies, or checking prices. Getting solid extra protection now might keep you from spending loads later.

FAQs

1. Is supplemental dental vision and hearing coverage worth it?

Yes. These extra options save money if you need regular check-ups, eyewear, dentist visits, or help with hearing. Because of them, you’ll spend way less time.

2. Does Medicare cover supplemental dental vision and hearing?

Original Medicare—Parts A and B—doesn’t pay for everything. So, extra coverage steps in to help out.

3. How much do supplemental plans cost?

Costs go from $20 up to $60 monthly—what you pay hinges on how old you are, where you live, or what extras come included.

4. Are waiting periods required?

Preventive treatment often starts right away—yet bigger dental work might need half a year or more before you can get it.

5. Can I bundle dental, vision & hearing coverage?

Absolutely. Combining cuts costs while making coverage easier to handle.

.