Prescription drug coverage changes in 2026 rules are shifting fast this year, thanks to fresh laws, growing medicine prices, and tweaks in coverage options, while officials try harder to lower bills for essential meds. If you’ve got Medicare, a personal plan, work-based care, or something from the exchange, these shifts hit your wallet—and affect how quickly you get needed pills.

What’s Changing in Prescription Drug Coverage in 2026?

In 2026, big shifts hit insurance options—Medicare Part D, Marketplace coverage, and private insurers. The goal? Slashing what you pay yourself and making costs clearer while offering stronger support if pricey meds are part of your life. Major Changes Include:

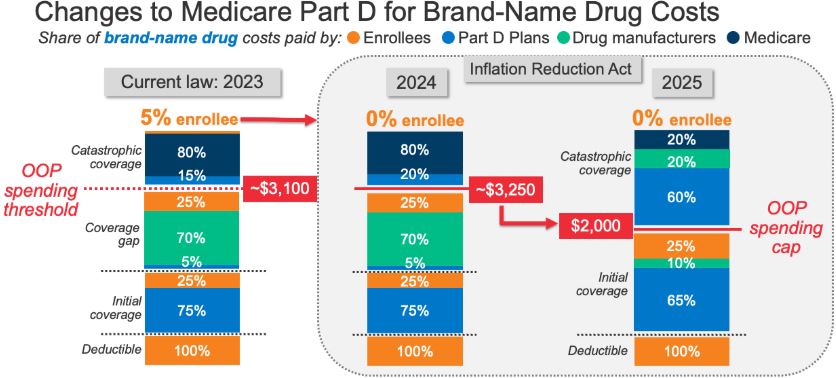

1. Lower Out-of-Pocket Maximums (Especially for Medicare Part D)

Beginning in 2026, Medicare Part D beneficiaries will have a cap on annual prescription drug spending, making medications more affordable for seniors and chronic illness patients.

2. Expansion of Generic & Biosimilar Coverage

Insurance providers are prioritizing generics and biosimilars to reduce pharmacy costs. More low-cost alternatives will be covered in 2026.

3. Anti-Price Gouging Regulations

New regulations aim to stop sudden, extreme price hikes for commonly used medications such as insulin, inhalers, and heart medications.

4. Improved Transparency Requirements

Insurers must provide clearer drug pricing information, coverage rules, and out-of-pocket estimates.

5. Changes to Formularies

Insurers are reshuffling drug lists to include more cost-effective medications. Some brand-name drugs may move to a higher tier, resulting in higher co-pays.

6. Preventive Medications Expanded

Plans will cover more preventive drugs—including diabetes prevention, heart disease medications, and vaccines—for little or no cost.

Why These Changes Matter

Pills you need might drain your wallet now. But this year’s updates could let people keep more money

- Cut your pharmacy bills each month—save cash without hassle

- Improve access to essential drugs

- Promote fair pricing in medicine—set steady regulations so expenses stay low, but still let all people get what they need

- Help folks managing ongoing health problems keep up with care while saving money

Older people, households, or anyone managing regular meds could end up saving cash down the road with these changes—thanks to lower costs piling up.

Pros & Cons of Prescription Drug Coverage Changes in 2026

Pros

1. Lower Annual Out-of-Pocket Costs

For folks on Medicare, limits on medical costs mean no surprise sky-high drug expenses each year.

2. Cheaper Alternatives Through Generics & Biosimilars

The growth of generic drugs under insurance lowers medicine prices a lot, also easing the burden on patients.

3. More Protection From Price Hikes

Stopping inflation means drug makers can’t hike prices—or they’ll face fines.

4. Better Access to Preventive Medications

Extra meds might come free to stop long-term health issues.

5. Greater Transparency

People will see how much meds cost up front when they buy them.

Cons

1. Some Brand-Name Drugs May Become More Expensive

Due to updates in the medication list, certain drugs could move to higher tiers, making them costlier at pickup. While this happens, your out-of-pocket price may go up once you get them filled.

2. Limited Availability of Certain Medications

Insurers could pick cheaper alternatives rather than expensive branded drugs 3. Possible Delays in Authorizations

3. Higher Premiums in Some Plans

Though you might pay less for meds yourself, your monthly insurance fee could go up instead.

How Consumers Can Prepare for 2026 Prescription Drug Changes

1. Review Your Insurance Plan’s Formulary

Check which medications are moving tiers, becoming generic, or losing coverage.

2. Ask Your Doctor About Alternatives

Some medications may have cheaper, equally effective generic versions in 2026.

3. Compare Plans During Open Enrollment

Since every insurer will update pricing differently, compare the deductible, co-pay, and formulary updates.

4. Track Your Annual Medication Spending

Knowing how much you typically spend helps determine if the new caps benefit you.

5. Utilize Preventive Drug Coverage

Take advantage of newly added free or low-cost preventive medications.

FAQs

1. How will prescription drug prices change in 2026?

In 2026, lots of medicines will cost less because of spending limits and broader access to generics, while also seeing tighter controls on how much drug makers can raise prices.

2. How do the 2026 Medicare Part D changes help seniors?

Medicare Part D now sets a yearly limit on how much people must pay themselves, so older adults won’t face endless charges for meds. Instead of footing the full bill, they’ll hit a max amount—after that, coverage kicks in more fully.

3. Will insurance cover more generic medications in 2026?

Yes. Insurance companies now cover more generic drugs—also including biosimilars—to help lower prices while giving people cheaper alternatives.

4. Are brand-name medications becoming harder to get under insurance in 2026?

Some insurance plans might limit how much they pay for pricey name-brand meds, steering people to less expensive options—unless a doctor says otherwise.

5. Can I change my prescription drug plan if these changes affect me? When sign-up time comes around, folks have a chance to change their health coverage—or swap out just the drug plan – so it lines up better with the meds they actually use.

Conclusion

Prescription drug coverage changes in 2026 might save U.S. patients cash on meds. Lower caps on prices, wider generic availability, or stricter pricing limits could mean simpler bills without hidden spikes. Yeah, some glitches may pop up—like revised med lists or modest premium bumps – but the aim is solid: reduce financial stress while creating fairer care access.

To stay protected, review your existing plan—explore various options while talking to your doctor about alternatives. Understanding changes today reduces expenses later, helping life flow more easily starting in 2026.