Microinsurance Policies are changing how people with tight budgets get financial safety nets. Built to be cheap, straightforward, and quick to obtain, these plans support at-risk groups facing issues like illness, death, crop loss, storms, or shop troubles. Instead of complex terms, they use clear rules so anyone can understand them. Because they’re small-scale, even street vendors or farmers can afford basic backup when things go wrong. This type of coverage spreads through local agents, mobile apps, or community networks—making it reachable almost anywhere.

In lots of poorer areas, regular insurance costs way too much or is just confusing. So instead, microinsurance steps in—providing cheaper rates and easier ways to pay, along with coverage that actually fits people’s real-life situations. With more folks asking for it across the globe, getting how these small-scale plans operate—or checking which policy beats another—matters a lot whether you’re buying, selling, or shaping rules.

This guide explains what you should understand about micro-insurance options while also looking at pros alongside drawbacks, and then highlights must-check traits prior to picking coverage.

What Are Microinsurance Policies?

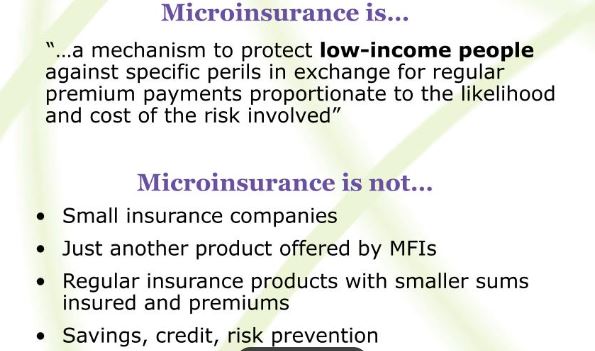

Microinsurance gives cheap protection to people earning little money, those in casual jobs, tiny companies, or groups left out of regular insurance options.

They usually cover:

- Health insurance

- Life or accidental protection

- Crop care along with animal safety

- Home coverage plus protection when disasters hit

- Micro-enterprise coverage

- Travel and loan-linked insurance

Instead of regular insurance, microinsurance costs less, adapts to your needs, and also pays out without hassle—so folks in far-off villages can use it just fine.

How MicroInsurance Works

Micro-insurance options come via:

- Microfinance institutions (MFIs)

- Cooms & local crews

- Non-governmental organizations (NGOs)

- Mobile network operators

- Local insurance companies

Premiums usually don’t cost much—they’re paid every week, once a month, or each season. To get claims done quickly, they use mobile cash transfers or online tools instead of paperwork.

This setup helps poor neighborhoods handle surprise money problems—say, sickness, injuries, bad harvests, or storms. It gives them a way to stay safe when life throws something tough their way without warning.

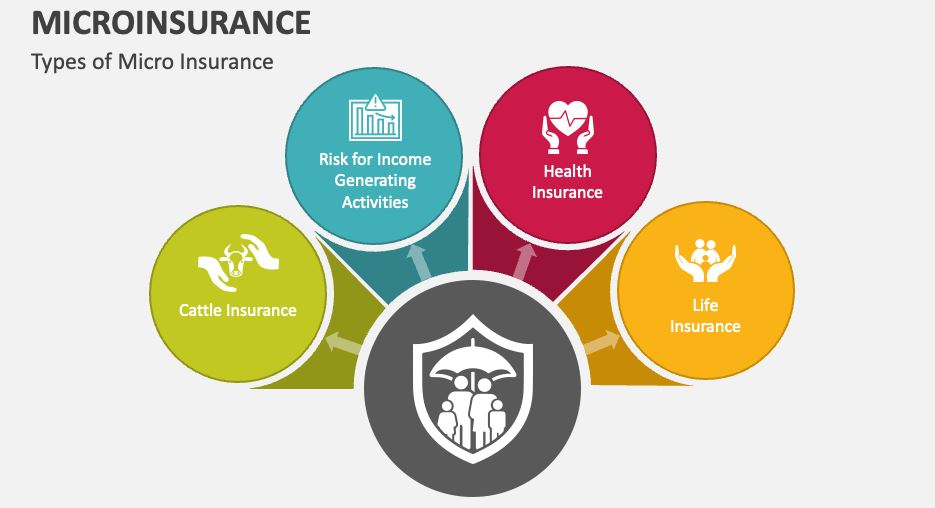

Types of Microinsurance Policies

1. Micro-Health Insurance

Covers stays in hospital plus doctor bills—also handles urgent care needs. A fine choice for households without official medical coverage—especially when options are tight.

2. Micro-Life and Accident Insurance

Keeps loved ones safe, money-wise, if someone dies or gets hurt by accident. Commonly tied to small loans or saving strategies.

3. Microinsurance for Agriculture

Shields farmers when crops fail, while animals die off due to dry spells, heavy rains, or bugs running wild. Favored across countryside areas, plus spots hit hard by the weather shifts.

4. Property and Disaster Insurance

Covers tiny houses, stores, and gear—also belongings—if flames hit, someone steals stuff, or bad events strike. Critical in nations facing frequent disasters.

5. Micro-Business Insurance

Supports tiny sellers, startup folks, or side-hustle pros in guarding their paychecks and daily survival.

Pros and Cons of Micro-Insurance Policies

Pros

Fair prices set up for people on tight budgets

Flexible payments—choose weekly or maybe monthly, even seasonal options

Sign up fast using phone apps or microfinance groups

Filing your claim fast—no piles of forms. Just straightforward steps that save time instead of wasting it

Shield your wallet when unexpected stuff hits. Keep cash safe during surprise storms

Helps families manage money while giving small shops a better shot at surviving

Cons

Less coverage than regular insurance—yet often cheaper, though not always enough to match big expenses

Might leave out certain risky situations or factors

Few options out in the countryside spots

Dependence on partner organizations like MFIs or NGOs, Awareness gaps, or poor money knowledge could slow things down

Why MicroInsurance Matters in 2026

Facing growing threats like extreme weather, shaky economies, or health crises, tiny insurance plans give hope to many struggling folks. Online tools now help more people join these programs fast—using phone payments, quick texts for claims, or signing up right in their neighborhoods.

Govts plus global groups now back small-scale insurance plans—aiming to boost access to banking while cutting poverty levels.

How to Choose the Right Micro-Insurance Policy

1. Assess Your Needs

Figure out if you want protection for your health, crops, business stuff, livestock, or things you own.

2. Check costs against what’s covered

Low prices pull you in—yet check if big dangers are covered.

3. Review Claim Requirements

Check for quick online claims, less paperwork, or clear timeframes.

4. Select a Trusted Provider

Pick groups that are active where you live—like credit unions, local co-ops, phone companies, or trusted insurance names.

5. Check Exclusions. Know the gaps—skip this, and you might get your claim denied.

Conclusion

Microinsurance shields poor families when money gets tight. Built to cost little, reach more people, and fit simple needs—it gives folks and tiny firms a way forward without much cash. Say you grow crops and fear bad weather—this covers that risk. A household wanting medical safety? This steps in. Run a small shop and worry about losses? It’s got your back, too.

With tech changing fast, microinsurance will grow, hitting new areas while giving stronger protection choices. Check plans carefully, know what’s not covered, and pick trustworthy companies so you end up with smart picks that help your money stay safe over time.

FAQs

1. What is microinsurance, and who is it for?

Micro-insurance means cheap coverage made for people with little money—like farmers or those running tiny shops—who usually can’t pay for regular policies. It helps them stay protected without high costs.

2. How much does microinsurance usually cost?

Premium costs next to nothing, sometimes just pennies or bucks monthly, basedon what’s covered.

3. How are claims processed in microinsurance?

Most providers stick to easy claim processes that need little paperwork, while a bunch send quick payments using mobile cash or nearby helpers.

4. What types of risks does microinsurance cover?

Health, along with life coverage, guards against injuries. Accidents pair up with crop harm to add protection layers. Livestock risks tie into disaster setbacks. Small ventures stay shielded when interruptions hit.

5. Can small businesses benefit from microinsurance?

Yes. Small business coverage safeguards gear, stock, earnings, and also daily work—backing up owners when money gets tight.