Medicare Part D changes in meds for older folks and others who qualify—it shifts each year. As medical bills climb and regulations shift, knowing how Part D updates work matters now more than before. If you’re setting up retirement plans, picking a different option, or guiding someone through medical prices, keeping track could cut your spending by big amounts.

The 2026 tweaks to Medicare Part D aim to lower prices, boost access, or clear up confusion. These shifts fit into broader efforts so people can afford key drugs. Here’s a no-jargon rundown—plain words, actual perks, plus tips from pros—to help you choose wisely.

What Is Medicare Part D?

Medicare Part D gives you extra help with medicine costs if you choose to sign up. This plan comes from private firms that Medicare says are okay. Instead of paying full price, you get discounts on pills people use every day. Both common versions and store-branded options fall under this protection.

People who have Medicare Part A or Part B are able to sign up for a Part D plan when the yearly enrollment opens.

Major Medicare Part D Changes for 2026

Here’s what recipients really need to watch out for next:

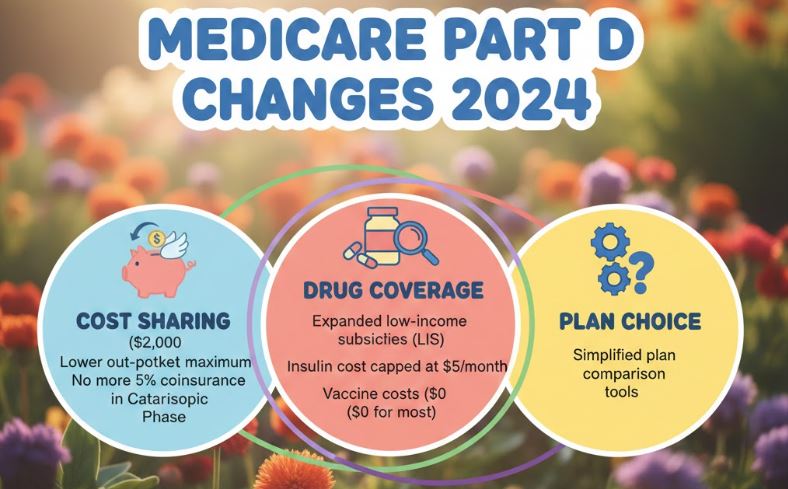

1. $2,000 Out-of-Pocket Spending Cap

Now, after years of no limits, people with Medicare Part D finally face a clear yearly maximum they’ll shell out for meds. Instead of paying endlessly, folks hit a cutoff point one day each cycle. This moment marks a shift from old rules that let costs pile up without control. From now on, once someone reaches this ceiling, their drug bills stop climbing further. It’s different than past setups where charges just kept adding regardless.

In 2026, you’ll cap at $2,000 a year for meds—no matter how pricey your specialty prescriptions get.

This helps older folks plan their money better while also cutting down stress about bills.

2. Expanded Low-Income Subsidy (LIS) Eligibility

Low-income folks on Medicare will see extra support through better benefits

- Monthly premiums

- Annual deductibles

- Copays and coinsurance

- Coverage gap expenses

This change helps those on low earnings get vital drugs more easily—so they can stay healthy without stress.

3. Drug Price Negotiation Begins

Medicare is starting talks on pricing for certain pricey meds. Little by little, this could lower expenses on everyday treatments for diabetes, plus some cancer therapies, along with medicines for heart issues or immune system disorders.

Beneficiaries could notice lower prices when additional medications get added to the discounted list in the coming years, thanks to gradual changes unfolding slowly.

4. Changes to Catastrophic Coverage

Up until 2026, after hitting the worst coverage stage, people covered 5% of drug expenses out of pocket—though that’s changing now.

Starting in 2026:

- The 5% coinsurance gets dropped.

- Hit $2,000? Then you’re done paying for meds that count—no extra costs the whole year after.

5. Smoother Premium Structure

Part D costs might change a bit because of the updated spending limit, yet prices should stay mostly steady. Plenty of options now include:

- Simplified benefits

- Transparent pricing

- Lower deductibles

This makes it simpler for recipients to check options when picking coverage.

Pros and Cons of Medicare Part D Changes

Pros

A few bucks saved when buying meds

A yearly limit of $2,000 keeps costs from getting out of hand

Broaden access for those on limited income

Less surprise in drug costs

Better reach to key medicines

Fewer expenses on pricey specialty meds when covered better

Cons

A small rise in monthly payments might happen

At first, layout setups could feel a bit harder to follow

Some medicines could shift to alternative lists

Limited options based on where you live or what’s offered nearby

Conclusion

The 2026 Medicare Part D updates aim to lower medication prices and boost access to critical drugs while giving older adults stronger money safeguards. Thanks to a fresh $2,000 limit, broader help with premiums, and talks on pricing, enrollees can expect real cuts in spending along with less worry.

If you take meds regularly—or someone close to you does—right now’s a good moment to check your insurance setup. Instead of guessing, look at what each option covers and how much it costs monthly, along with which drugs are included; that way, you pick one matching both your wellness goals and wallet limits. Keeping up with these shifts lets you choose wisely now—so your body stays strong down the road.

FAQs

1. What is the biggest Medicare Part D change for 2026?

The biggest shift? A $2,000 yearly limit on what you pay for meds—once hit, costs stop piling up. Instead of endless bills, your spending tops out no matter how many scripts you need.

2. Will my Medicare Part D premiums increase because of these changes?

Some plans might tweak prices a bit; yet, many users will keep more cash thanks to lower med expenses along with the updated cost limit.

3. Do the changes affect all medications?

Yes. That $2,000 limit plus ditching extra charges for high-cost drugs works on every Part D medicine. But only if it’s a drug they actually cover.

4. Who qualifies for the expanded Low-Income Subsidy?

Qualifying depends on how much you earn or own. Now, extra older adults can get support paying insurance costs, gaps in coverage, and fees when seeing a doctor.

5. Should I change my Medicare Part D plan?

You could check options when enrollment opens. Sometimes different drug lists, out-of-pocket costs, or monthly fees make a change worth it.