Insurance in Canada offers diverse coverage options for individuals, families, and businesses. This guide explores various insurance types, regulatory oversight, and key considerations for those seeking coverage.

Table of Contents

- Varieties of Insurance in Canada

- Auto Insurance

- Home Insurance

- Life Insurance

- Health Insurance

- Travel Insurance

- Business Insurance

- Small Business Insurance

- Home-based business liability insurance

- Restaurant Business interruption insurance

- Affordable Life Insurance for Seniors in Canada

- Vacant Property Insurance Quotes

- Regulatory Framework

- Provincial Oversight

- The Office of the Superintendent of Financial Institutions (OSFI)

- Auto Insurance in Canada

- Mandatory Coverage

- Additional Coverage Choices

- Factors Impacting Auto Insurance Premiums

- Strategies for Securing Affordable Auto Insurance

- Home Insurance in Canada

- Home Insurance Types

- Coverage Specifics

- Factors Influencing Home Insurance Premiums

- Selecting the Optimal Home Insurance Policy

- Life Insurance in Canada

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variables Affecting Life Insurance Premiums

- Significance of Life Insurance for Canadians

- Health Insurance in Canada

- Public Health Insurance (Medicare)

- Private Health Insurance

- Considerations for Choosing Health Insurance

- Role of Health Insurance in the Canadian Healthcare System

- Travel Insurance in Canada

- Travel Insurance Varieties

- Benefits of Travel Insurance

- Procuring Travel Insurance

- Travel Insurance Advice for Canadians

- Business Insurance in Canada

- Business Insurance Categories

- Aspects Influencing Business Insurance Costs

- Significance of Business Insurance

- Determining Adequate Business Insurance Coverage

- Insurance Fraud in Canada

- Insurance Fraud Types

- Strategies to Counter Insurance Fraud

- Reporting Suspected Insurance Fraud

Conclusion: Navigating the Canadian Insurance Landscape

1. Varieties of Insurance in Canada

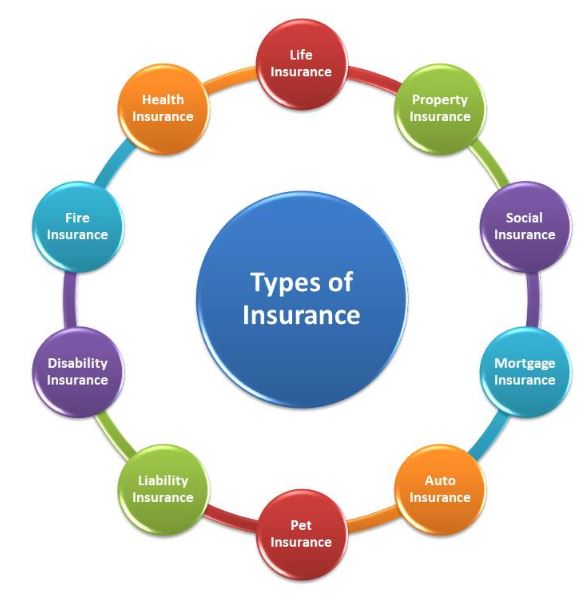

Canada presents a diverse range of insurance options to cater to various needs and circumstances. Some of the most common insurance types in Canada encompass:

Auto Insurance: Mandatory in most provinces and territories, auto insurance covers costs linked to vehicle damage, injuries, and liability following an accident.

Home Insurance: Protecting homeowners and renters from property damage, theft, and liability, home insurance is essential for safeguarding residences and possessions.

Life Insurance: Offering financial security to beneficiaries upon the policyholder’s demise, life insurance comes in diverse forms, such as term life, whole life, and universal life insurance.

Health Insurance: Despite Canada’s publicly funded healthcare system, private health insurance can cover supplementary medical expenses like prescription drugs, dental care, and vision care.

Travel Insurance: Crucial for Canadian travelers heading abroad, travel insurance safeguards against trip cancellations, medical emergencies, and lost luggage.

Business Insurance: Canadian businesses can select from a variety of insurance options, including liability insurance, property insurance, and commercial auto insurance, to protect their assets and operations.

2. Regulatory Framework

The Canadian insurance sector operates within a highly regulated framework, designed to ensure consumer protection and financial stability. Key regulatory bodies and structures include:

Provincial Oversight: Insurance regulation falls primarily under provincial jurisdiction, with each province and territory possessing its regulatory authority. These authorities supervise insurance companies’ operations, licensing, and handling of consumer complaints.

The Office of the Superintendent of Financial Institutions (OSFI): OSFI acts as the federal regulator, responsible for overseeing federally chartered insurance companies, ensuring their financial solvency, and enforcing federal regulations.

3. Auto Insurance in Canada

Auto insurance is a mandatory requirement for all vehicle owners in Canada, with specific coverage mandates varying by province. Generally, compulsory coverage encompasses third-party liability, accident benefits, direct compensation-property damage (DCPD), and uninsured motorist coverage. Additional coverage options are available for individuals seeking enhanced protection.

Factors influencing auto insurance premiums in Canada encompass driving history, vehicle type, geographical location, and selected coverage. To discover cost-effective auto insurance options, consumers can engage in comparative shopping, bundling policies, and maintaining a clean driving record.

4. Home Insurance in Canada

Home insurance in Canada offers protection against property damage, theft, and liability. Various types of home insurance policies exist, including comprehensive, basic, and condominium insurance. Premium calculations consider factors like the property’s location, age, and security features.

Selecting the appropriate home insurance policy necessitates a careful assessment of individual requirements and property characteristics. Policyholders should periodically review their coverage to ensure it aligns with their present circumstances.

5. Life Insurance in Canada

Life insurance stands as a crucial financial tool for Canadians looking to provide financial security for their loved ones upon their passing. Available in various forms, including term life, whole life, and universal life, life insurance policies offer distinct features.

Premium determinants for life insurance include age, health condition, smoking status, and coverage amount. Canadians should conscientiously evaluate their insurance needs and seek guidance from financial professionals when selecting a life insurance policy.

6. Health Insurance in Canada

Although Canada’s public healthcare system, known as Medicare, covers essential medical services, private health insurance can extend coverage to include services not included in the public plan, such as prescription drugs, dental care, and vision care.

When contemplating health insurance options, Canadians should consider their healthcare requirements and budget constraints. Private health insurance plans come in diverse forms, offering various levels of coverage.

7. Travel Insurance in Canada

Travel insurance proves indispensable for Canadian travelers venturing abroad. It offers protection against unanticipated occurrences such as trip cancellations, medical emergencies, and lost baggage. Types of travel insurance encompass trip cancellation insurance, emergency medical insurance, and comprehensive travel insurance.

Prospective travelers should thoroughly scrutinize policy details, including coverage limits and exclusions, before procuring travel insurance. It is advisable to purchase coverage well in advance of planned travel.

8. Business Insurance in Canada

Canadian businesses encounter an array of risks, ranging from property damage to liability claims. Business insurance options encompass general liability insurance, property insurance, commercial auto insurance, and workers’ compensation insurance.

Determination of the optimal business insurance coverage necessitates an evaluation of the specific risks linked to the industry and business operations. Small businesses, in particular, should take measures to shield their assets and reputation by securing appropriate insurance.

9. Insurance Fraud in Canada

Insurance fraud is a substantial concern in Canada, resulting in significant financial losses annually. Common forms of insurance fraud encompass staged accidents, inflated claims, and misrepresentation of information. Combatting fraud involves policyholders reporting suspicious activities to their insurance providers or authorities.

Preventing insurance fraud requires vigilance, the provision of accurate information, and verification of the legitimacy of claims. Collaboration between insurance companies and regulatory entities is instrumental in detecting and deterring fraudulent activities.

Conclusion

Insurance in Canada represents a multifaceted industry, providing protection and financial security to individuals and businesses. Comprehending the various insurance types, the regulatory framework, and factors influencing premiums is vital for making

FAQs

- What types of insurance are most common in Canada?

Health, along with car and house coverage, plus life and work-related protection, make up the top buys across Canada. - Is health insurance free in Canada?

Folks get basic medical care paid for by the government—yet many rely on personal coverage to handle dentist visits, eye checkups, meds, or extra services. - How much does car insurance cost in Canada?

Typically, auto coverage costs between $1,200 and $2,000 yearly—what do you pay, though? That’s shaped by where you live, how you drive, and also what kind of car you’ve got. - Do homeowners need insurance in Canada?

Yes, homeowner’s coverage guards your house against fires, break-ins, leaks, or if someone sues you. Most banks insist on it before loaning money. - Is life insurance important in Canada?

Yes, life insurance can pay off what you owe, handle burial fees, and also give cash help to loved ones when you’re gone.