Indexed Universal Life insurance plans are gaining popularity among U.S. families who want adjustable protection along with cash buildup that avoids taxes and ties to market ups and downs. If retiring sooner is your goal, if growing money steadily matters, or if having lifelong insurance without gambling on Wall Street appeals to you, this type of policy might fit well.

So, how does an IUL really function? Could it be a good pick for you? Yet, what’s key for newbies to get before jumping in?

This full walkthrough explains Indexed Universal Life Insurance (IUL) using everyday words—helping you choose wisely without confusion. While it’s packed with clarity, each part unfolds step by step; nothing feels rushed or vague. As things move forward, ideas link naturally, yet every line stands clear on its own. No fluff sneaks in, just straight talk that fits neatly where it should.

What Is Indexed Universal Life Insurance?

Indexed Universal Life insurance is a type of lifelong coverage that gives you these benefits:

Lifetime payout when you pass away

Cash gains follow a market index—say, the S&P 500—with ups and downs linked directly to its performance

Grow your money without paying taxes now, then take cash later tax-free if you follow IRS guidelines

✔ Flexible premiums

Instead of regular universal life, IUL builds cash value using a chosen market index—without actually putting money into stocks. So it works like this:

- You gain when markets rise—though only up to a limit.

- You’re shielded if markets drop—there’s a 0% minimum to keep you safe.

Even when markets crash, your cash value stays safe from losses caused by poor index performance.

How an IUL Policy Works

Here’s an easy look at it:

1. You pay premiums

A bit covers insurance fees, while the remainder heads into your cash savings pot.

2. Your cash value is tied to an index

Popular choices are things like

S&P 500

Nasdaq 100

Russell 2000

Euro Stoxx 50

3. You get interest tied to how the index performs—so your return shifts when it does

Your results depend on:

Cap rate—the most you could make in interest

Share of the index rise that counts

Floor rate means the lowest interest you can get—often zero percent

4. Your money builds up without taxes for now.

You can tap into cash down the line through no-tax loan options from your policy.

Who Should Consider an IUL Policy?

IUL works well for:

- People who want to grow money over time

- Folks who make a lot of money, yet want ways to save on taxes

- Parents saving for education planning

- Entrepreneurs who want reward setups for top staff

- People looking for lasting security, along with chances to grow

If you’re looking for market-linked growth without full exposure to stock market risk, IUL is worth exploring.

Pros and Cons of Indexed Universal Life (IUL)

Understanding the strengths and weaknesses of IUL is essential before buying.

✔ Pros of IUL Insurance

1. Market-Linked Growth With Downside Protection

You gain earnings when the index goes up, yet your balance won’t drop if it falls.

2. Tax-Free Retirement Income

Tap into your policy’s cash by taking loans—these stay tax-free as long as you handle them right.

3. Flexible Premiums

Boost your premium to speed up cash growth—or slash it when money’s tight.

4. Lifetime Coverage

If you keep paying the premium, your coverage stays active—no end date in sight.

5. Customizable Riders

Options include:

- Living benefits

- Critical illness

- Long-term care

- Accidental death

✘ Cons of IUL Insurance

1. Caps Limit Your Returns

If the index rises by 12% yet your limit’s just 9%, you’ll get exactly 9%.

2. Policy Fees Can Be High

Insurance gets pricier the older you get.

3. Requires Long-Term Commitment

IUL performs well if you keep putting money in regularly over a decade or more.

4. Complexity

Caps or floors—participation rates plus loan kinds might puzzle newbies.

5. Risk of Policy Lapse

If funds run short, the plan might fail, more likely as time goes on.

Conclusion

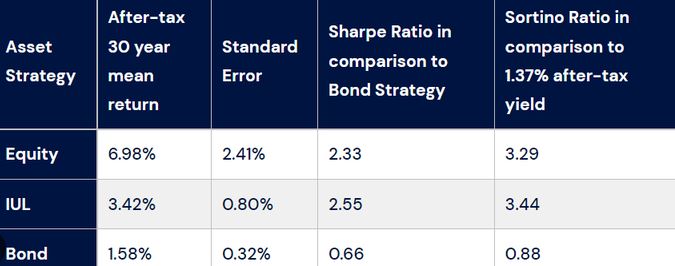

IUL insurance offers a way to grow money over time with less stock market risk while also giving tax perks and lasting coverage. Not some quick-cash scheme—instead, if you feed it steadily and keep an eye on it, this policy can deliver a steady financial footing, retirement cash you won’t owe taxes on, or a solid safety net for loved ones down the road.

Check what you want money-wise first, get how the plan works instead, then look at different IUL options from solid companies. Use a smart approach—this kind of insurance might turn into a key part of your finances.

FAQ

1. Is an IUL a good investment?

Answer: It could fit your needs if you’re after steady gains without big risks—but it’s not meant to replace standard investment methods. Try using it mostly to grow money gradually, also reducing tax bills along the way.

2. How much does an IUL cost per month?

Answer: Prices shift depending on age, health status, or coverage type. Certain options start around $150–$300 a month, but those earning more often pay higher amounts to grow their reserves faster.

3. Can I lose money in an IUL?

Answer: You won’t lose cash if the index falls—it’s shielded by a floor of zero – but fees or loans could eat into your total if you don’t manage them well.

4. How long does an IUL take to grow?

Answer: Most plans begin doing better around year five or seven—after that, things speed up once you hit twelve. Things get good when you’ve stuck with it past ten.

5. Is IUL better than whole life?

Answer: If you want larger rewards, solid flexibility, or performance linked to market shifts, IUL might fit better. Then again, whole life offers clearer outcomes—even if progress feels sluggish.