Introduction

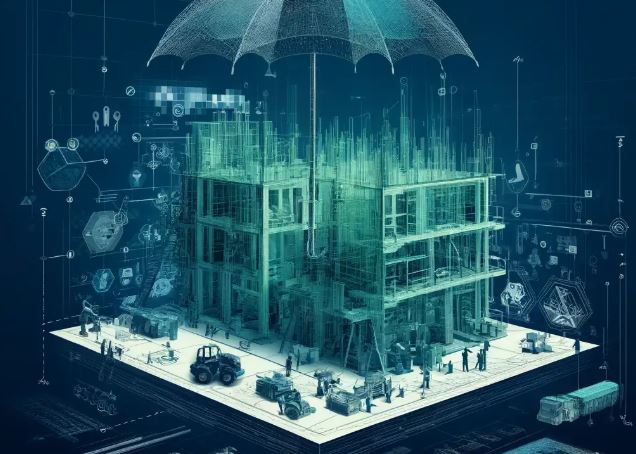

Builder risk insurance, picture this—the hammers are swinging, the cement mixers are whirring, and the foundation of a new building project is taking shape. Amidst the excitement, there’s a silent guardian that stands ready to shield this construction endeavor from unexpected setbacks—Builder’s Risk Insurance. In this guide, we’re diving into the heart of Builder’s Risk Insurance, its significance, the protective umbrella it offers, its perks, and the vital factors to mull over. As we navigate this exploration, let’s weave in some SEO magic to ensure that those seeking insights into this insurance niche find their way to this treasure trove of information.

Imagine Builder’s Risk Insurance as a reassuring embrace for construction projects, providing a safety net against unforeseen mishaps during the construction or renovation journey. Designed to be a financial safety cushion, this insurance isn’t just for the structure itself—it’s a shield that extends to property owners, contractors, and builders, guarding against unexpected events like fires, theft, vandalism, and even nature’s fury.

Building Risk Insurance Coverage Galore: Shielding Your Dream Build

Think of builder’s Risk Insurance as a versatile cloak that wraps around your construction venture. It covers a range of risks, including:

- Property in Peril: This covers damages to the building in progress, along with materials and supplies eagerly waiting to find their place.

- Guard against Grinches: Protection against the cunning hands of thieves who might eye the construction site’s materials or equipment, as well as safeguarding against malicious acts of vandalism.

- Fire’s Foe: Coverage that steps in when the flames dance unexpectedly during construction.

- Nature’s Fury: Depending on the policy, it can even shield you from the wrath of earthquakes, hurricanes, floods, and similar acts of nature.

- Speeding Up with Style: Ever thought about what happens when a covered loss slows down your project? This coverage reimburses the extra expenses incurred to get things back on track.

- Tidying Up: There’s elegance in cleaning up—even when it’s the debris post a covered loss event. This coverage caters to the costs involved.

Perks That Pack a Punch

- Risk’s Silent Opponent: As the project’s unsung hero, Builder’s Risk Insurance tackles financial risks head-on, providing a safety net for everyone involved. It’s the shield that stands tall when unforeseen events knock on the construction site’s door.

- Uninterrupted Symphony: In the face of a covered loss, this insurance acts as the maestro, ensuring that the construction project’s symphony plays on without missing a beat. It averts disruptions, curbs delays, and keeps financial woes at bay.

- Dollars and Sense: When it comes to the financial battlefield, Builder’s Risk Insurance is your ally. It cushions you from the impact of unexpected expenses, saving property owners and contractors from bearing the brunt.

- Zen Zone: Peace of mind is a priceless commodity. With Builder’s Risk Insurance in place, the orchestra of worry subsides, allowing property owners, contractors, and builders to focus on the masterpiece in the making.

Navigating the Builder’s Risk Labyrinth

- Ceiling of Coverage: Imagine this as the protective canopy. The coverage limit in your policy should match the project’s total value—considering materials, labor, and more.

- Time’s Tapestry: The coverage period should be in sync with the estimated project completion. Let the policy and the project timeline dance harmoniously.

- Exclusion Clues: Every masterpiece has its boundaries. Delve into the policy to understand what’s excluded, ensuring you’re prepared.

- Deductible Dance: Before the insurance tango begins, there’s the deductible to meet. Understand the cost you’d need to cover before the policy kicks in.

- Party of Stakeholders: It’s an exclusive affair—ensure all relevant parties, like contractors, subcontractors, and property owners, are properly included.

- Project’s Unique Traits: Imagine this as tailoring—furnish accurate project details to make sure the policy is custom-fitted to the project’s nuances.

Sealing the Deal on Builder’s Risk Insurance

- Guided by Experts: Think of insurance agents as your sherpa in the insurance mountain. Seek professionals well-versed in construction insurance for tailored guidance.

- Quotes as Compass: Don’t choose blindly—gather quotes from different providers. Compare and contrast to find the best fit.

- Policies Under the Microscope: It’s a fine print affair. Dive into the policy’s terms and conditions to understand its rhythm and nuances.

- Curiosity’s Call: Never shy away from asking questions. When clarity is the destination, curiosity is the vehicle.

Conclusion

In the dynamic arena of construction, Builder’s Risk Insurance emerges as the sentinel of security, protecting investments and cushioning the blow of the unexpected. From safeguarding against theft to standing strong against the forces of nature, this insurance embodies tranquility for property owners, contractors, and builders. Armed with insights into coverage, advantages, and the fine print, you’re poised to make educated choices, anchoring your construction dream with the fortified embrace of Builder’s Risk Insurance. As you embark on your construction journey, remember that every masterpiece deserves the assurance that Builder’s Risk Insurance offers—a safeguard against the unknown and a testament to the beauty of preparedness.

FAQs

- What is builder risk insurance?

It’s an insurance plan for structures still being built, guarding against harm, stealing, or disappearance. - Who needs builder risk insurance?

Contractors, builders, property owners, and developers working on new builds or renovations. - What does Builder Risk Insurance cover?

Covers fire or theft, plus vandalism—also handles weather harm and supplies, along with gear right at the location. - How much does Builder Risk Insurance cost?

Usually between 1% and 5% of the whole build cost—scales with how big or risky the job is. - How long does Builder Risk Insurance last?

Coverage sticks around through the whole build, till work wraps up or someone moves in.