Disability Insurance Short and Long Term: Life’s full of surprises, so when sickness or injury hits, it might stop you from doing your job. This is why having disability coverage—like short-term or long-term options—really matters. No matter if you clock in at an office, run your own thing, take freelance gigs, or hustle independently, this protection keeps money coming even if you can’t work for a while—or forever.

With money troubles growing while healthcare gets pricier, having disability protection by 2026 feels way more necessary. This breakdown shows what disability coverage actually does, when it helps, how short-term differs from long-term plans, and the upsides and downsides, along with common queries, so you can pick a policy that fits your life.

What Is Disability Insurance?

If you can’t work due to an injury, sickness, or health issue, disability coverage gives back some of your lost pay. Instead of covering doctor costs, this protection keeps your paycheck steady – so it’s smart to include in money plans.

Some come in two key forms:

- Short-Term Disability Insurance (STD)

- Pays you when you’re off work for a short time—could be weeks or even months.

- Long-Term Disability Insurance (LTD)

- Covers deeper issues—ones that stick around for ages, maybe forever.

Each one helps you stay on track financially when surprises hit.

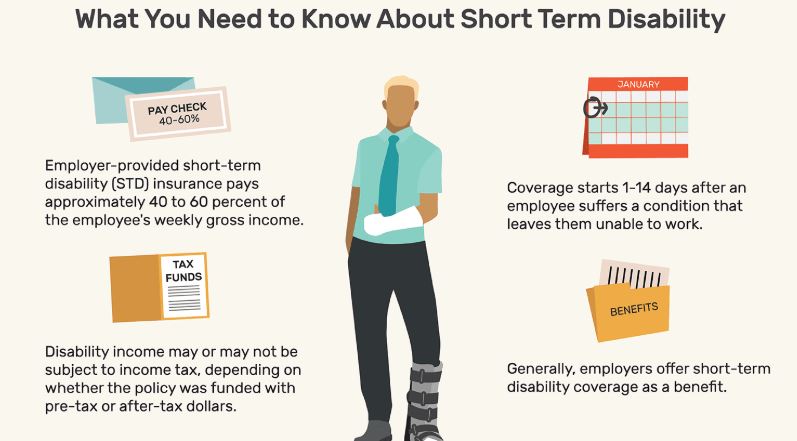

Short-Term Disability Insurance: What It Covers

Short-term disability coverage gives fast cash help when you’re unable to work due to health issues.

Pregnancy followed by healing after birth

- Minor surgeries

- Short-term illness

- Temporary injuries

- Stress-related work leave

Most temporary disability schemes pay roughly four out of ten to seven out of ten bucks you make—yet just for a stretch, typically ranging from three to twelve months, depending on your plan details.

Key Benefits of Short-Term Disability Insurance

- Immediate financial support

- Quick claim approval

- Fine for short-term job gaps

- Affordable premiums

- Usually offered through your job

·

Long-Term Disability Insurance: What It Covers

Long-term disability (LTD) insurance helps when health issues are serious enough to keep you out of work past half a year, like ongoing illnesses or lasting injuries

Musculoskeletal disorders

Cancer

Chronic illnesses

Mental health disorders

Severe injuries

Neurological conditions

LTD covers about half to two-thirds of what you earn, but how long it pays depends on:

- Several years

- Until retirement age

- Lifetime—varies by plan

Key Benefits of Long-Term Disability Insurance

- Strong income protection

- Critical during big health emergencies

- Long-term financial security

- Covers major health issues

- Fine for freelancers—also great if you make big money

Pros and Cons of Disability Insurance (Short & Long Term)

Pros

Make sure you get steady money instead

Lowers money worries if you get sick or hurt

Covers many health issues—like diabetes, heart problems, or asthma—while also handling injuries and infections without fuss

Long-term options give longer-lasting money safety

Perfect for workers or freelancers alike

Keeps your daily life running, covers rent, or handles kid costs

Cons

Long-term disability coverage might cost a lot

Health issues you already have could mean certain treatments aren’t covered

There could be a delay before you start getting benefits

Some bosses don’t cover disability, and short-term options give smaller coverage periods

How to Choose the Right Disability Insurance Plan in 2026

Finding the right plan, how you live, what bills you’ve got, and how much risk you can handle. Think about this:

✔ Evaluate Income Replacement Percentage

Aim for a plan that covers about two-thirds of what you earn—go with something like that.

✔ Check Benefit Duration

Short-term lasts a few months, whereas long-term can stretch over several years—pick according to your work situation and money goals.

✔ Understand Waiting Periods

The waiting time can last anywhere from a week up to half a year, depending on which plan you’ve got.

✔ Compare Premium Costs

Short-term options are cheaper—yet they last just a few months. On the flip side, long-term ones hit your wallet harder, though they guard you better.

✔ Review Definitions of Disability

One policy might pay if you can’t do your job, whereas another only pays if you can’t work at any job

Running your own gig gives stronger safety.

Every job could come with tough rules.

Look at job-based versus personal insurance options

Employer options cost less—though they might cover fewer things. On the flip side, private ones let you tweak details your way.

✔ Look for Riders (Optional Add-Ons)

- Cost-of-living adjustments (COLA)

- Partial disability benefits

- Extra money later on boosters

- Enhanced residual benefits

Why Disability Insurance Is Essential in 2026

When health troubles hit out of nowhere, money worries pile up fast—yet disability coverage keeps you steady. One slip, one bad scan, and life flips upside down—but this kind of protection holds your finances together while you heal.

Conclusion

Short-term or long-term disability coverage helps guard your paycheck when life gets rough. If you’re out sick for a few months, short-term plans step in. For deeper health problems that stick around, go with long-term support instead. Learn what each policy covers, weigh your choices carefully, then pick one that fits—so money stress won’t hit later on. Disability coverage? More like a wise move to protect what’s ahead.

FAQ

1. Is disability insurance worth it?

Yes—if sickness or an accident stops you from working, this coverage keeps money coming in. So instead of stressing over payments, you handle rent while healing up. It’s there, so basic costs don’t pile on top when things go sideways.

2. What is the difference between short-term and long-term disability insurance?

Short-term helps when you’re off work for a few months due to health issues, whereas long-term steps in if the problem drags on for years—or never fully goes away.

3. How much disability insurance coverage do I need?

Many folks require protection worth around six out of ten to seven out of ten parts of what they earn just to keep money steady.

4. Does disability insurance cover mental health conditions?

Yes—lots of today’s plans include help for stress, sadness, trauma reactions, or similar emotional struggles.

5. Can self-employed individuals get disability insurance?

Fully. These private plans work well for self-employed folks, like freelancers or solo entrepreneurs lack company-backed coverage.