Cyber liability insurance for online businesses in today’s digital world comes with endless opportunities—but also significant risks. With cyberattacks increasing every year, no business is completely safe from data breaches, ransomware, hacking, identity theft, and system failures. Whether you manage an e-commerce store, digital agency, SaaS company, or online services platform, cyber liability insurance has become one of the most essential protections for 2025.

Cyber liability insurance helps online businesses recover financially from cyber incidents that could lead to data loss, downtime, customer lawsuits, and major reputational damage. As companies grow more dependent on digital tools and cloud applications, having the right insurance can make the difference between quick recovery and permanent shutdown.

In this detailed guide, we’ll explore how cyber liability insurance works, why online businesses need it, its pros and cons, and how to choose the best policy.

What Is Cyber Liability Insurance?

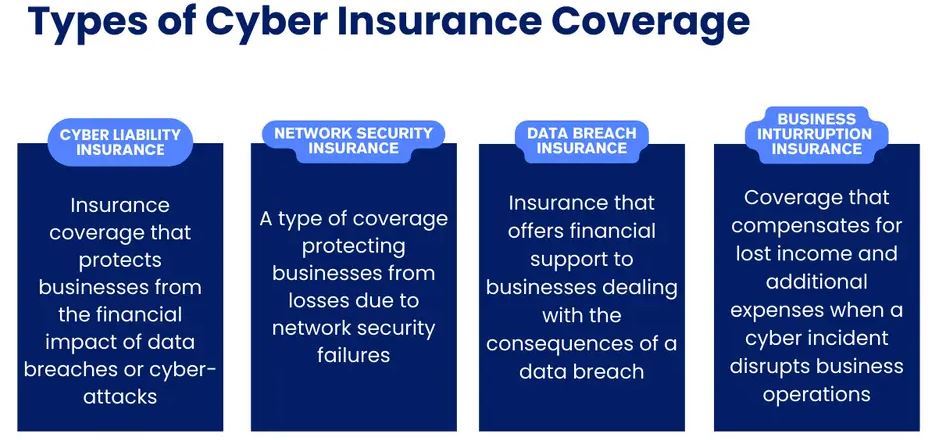

Cyber liability insurance is a specialized policy that protects businesses from financial losses caused by cyberattacks and technology-related risks. These risks include data breaches, ransomware, phishing attacks, malware infections, server failures, and stolen customer information.

Unlike standard business insurance, cyber liability insurance focuses directly on digital threats. It can cover everything from legal fees and customer notifications to system restoration, lost income, and regulatory fines. With the rise of e-commerce and remote work, even small businesses are now primary targets for hackers. Online businesses face unique risks because they collect customer data, process payments, store digital files, and interact with users across multiple platforms. A single cyberattack can shut down a website for days, damage customer trust, and cost thousands of dollars in recovery. Cyber liability insurance offers a financial safety net.

Why Online Businesses Need Cyber Liability Insurance in 2025

With cybercrime expected to reach new highs in 2025, here is why online businesses cannot afford to operate without this protection:

1. Increasing Cyberattacks

Hackers target online shops, social media sellers, cloud-based systems, and digital startups because they often lack strong security. Ransomware and phishing attacks are especially common.

2. Data Breach Liability

If customer data—such as emails, payment details, passwords, or personal information—is exposed, your business could face legal actions from affected users.

3. Costly Downtime

Every minute of website downtime results in lost revenue. Cyber insurance covers business interruption losses.

4. High Recovery Costs

Recovering a hacked website, removing malware, rebuilding databases, and hiring IT experts can be extremely expensive.

5. Compliance Requirements

Many industries must legally protect customer data. Insurance helps cover compliance-related costs and penalties.

6. Protecting Brand Reputation

When customer trust is damaged, online businesses lose sales, followers, and visibility. Insurance supports crisis management and PR recovery.

Coverage Included in Cyber Liability Insurance

Cyber liability policies typically include two major components:

1. First-Party Coverage (Direct Losses)

This covers your business’s own damages after an attack. It typically includes:

- Data recovery and file restoration

- Ransomware payments and negotiation

- Website and system repair

- Business interruption (lost income)

- Cyber extortion support

- Crisis management and PR services

2. Third-Party Coverage (Lawsuits & Claims)

This protects your business against claims from customers, clients, partners, or other affected parties. It typically includes:

- Privacy breach lawsuits

- Customer notification costs

- Regulatory fines and penalties

- Legal defense fees

- Settlement payouts

Both types of coverage are essential for online businesses storing customer data or running transaction-based services.

Pros and Cons of Cyber Liability Insurance

Pros

1. Financial Protection Against Cybercrime

Insurance covers the costs of recovery, legal defense, and business losses after a cyberattack.

2. Helps Maintain Customer Trust

Insured businesses respond faster to crises and protect their brand image.

3. Reduces Business Downtime

Policies help restore systems quickly, reducing lost sales and operational delays.

4. Covers Legal and Regulatory Requirements

Data protection laws are strict. Cyber insurance helps manage fines and compliance costs.

5. Supports All Types of Online Businesses

From small e-commerce stores to large SaaS companies, coverage is flexible.

Cons

1. Premium Costs Can Be High

Businesses handling large amounts of data or payment information may face higher insurance prices.

2. Not All Cyber Incidents Are Covered

Some policies exclude human errors, outdated software, or employee negligence.

3. Coverage Can Be Complex to Understand

Businesses must carefully review policy limits, inclusions, and exclusions.

4. No Insurance Can Prevent All Cyber Risks

Insurance provides financial recovery—not guaranteed protection from attacks.

5. Extra Security Measures Required

Providers may require strong cybersecurity practices before granting coverage.

How to Choose the Right Cyber Liability Insurance Policy

When comparing policies, focus on:

- The type of online business you operate

- The amount and sensitivity of the data you store

- The financial limits of each coverage area

- Exclusions and conditions

- Reputation of the insurance provider

- Whether the policy includes ransomware protection

- Requirements for cybersecurity practices

Working with an insurance expert or broker can help you select a policy designed specifically for digital businesses.

Conclusion

In 2025, cyber liability insurance is one of the most essential protections for online businesses of all sizes. Cyber threats continue to grow, and digital companies are often the first to be targeted. While strong cybersecurity systems are important, they cannot guarantee complete safety. Insurance adds a powerful financial shield that supports recovery, protects customer relationships, and reduces downtime. Whether you manage an e-commerce store, online service platform, or digital agency, investing in cyber liability insurance helps secure your business’s long-term future.

FAQs

- What is cyber liability insurance?

Shields digital ventures when hackers strike, while covering fallout from leaks or system intrusions. - Why do online businesses need it?

To reduce financial risk and recover quickly after a cyber incident. - Does it cover data breaches?

Yes, many plans include coverage for incident handling, attorney fees, and alerting affected parties. - How much does it cost?

Fees usually range from $500 to $5,000 annually—the scale shifts with company scope or exposure level. - What is not covered?

It leaves out weak security habits along with deliberate digital harm.