Cheap car insurance options by state: Finding affordable car insurance by state might seem tough—especially since costs swing wildly depending on where you are. Because each area has its own rules for basic coverage, plus differences in how many insurers compete and how often crashes happen, your bill gets shaped by lots of pieces. If you’re just starting out behind the wheel, trying to save cash for your household, or hunting for a better rate after yours jumped, knowing how policies shift across states could actually lower what you shell out.

This guide explains what you need to know about cheap car insurance in different states, points out the main upsides and downsides, and shows ways to get lower prices while still keeping coverage that’s legally needed.

Why Car Insurance Costs Vary State by State

Car insurance costs depend a lot on local rules. Take Florida or Michigan – places with no-blame setups tend to charge more because they cover extra medical care. On the flip side, areas using fault-based models, like Texas or California, usually offer cheaper entry rates since companies fight harder for customers.

Other factors include:

- Population density

- Weather changes or natural catastrophes

- Crime rates

- Average repair costs

- Minimum liability requirements

- Mandatory coverage for accidental harm

Figuring out these factors lets you see which quote’s a better deal – so you skip paying extra.

Top States With the Cheapest Car Insurance Options

1. Maine

Maine usually sits near the top when it comes to cheap car insurance. Fewer crashes, along with fewer people living close together, help hold costs down.

2. Ohio

Ohio sees tough battles between insurance firms, so folks can hop around to find better deals. Yet switching plans feels smooth thanks to all the rivalry pushing choices up front.

3. Idaho

Smaller towns in Idaho mean less crowded roads, so insurance costs drop when you look at them beside nationwide rates

4. Vermont

Vermont drivers see fewer crashes, lighter roads, or lower coverage costs.

5. Wisconsin

Wisconsin pairs fair rules with solid insurance options, which works well when you’re watching your wallet.

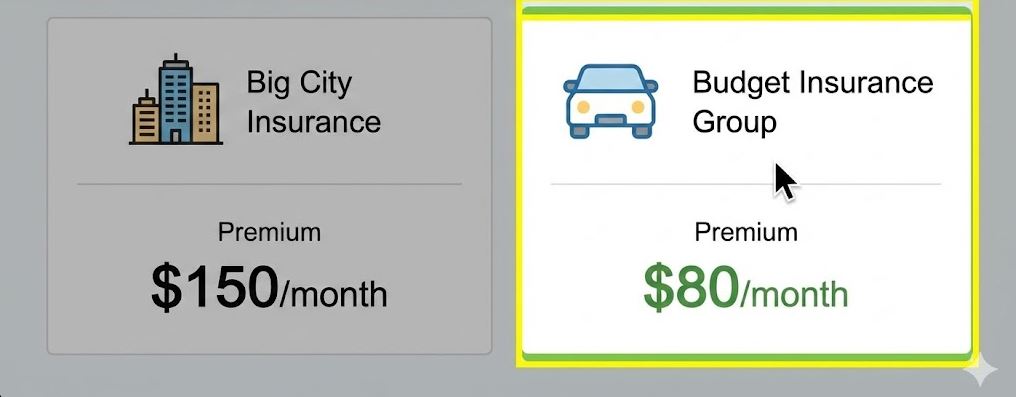

How to Find Cheap Car Insurance in Your State

Even when prices are steep in your area, you can still save—try comparing plans regularly or adjusting coverage to fit what you actually need

Check prices from no fewer than five insurance providers

- Increase your deductible

- Check if they offer a package deal—like home with car insurance

- Maintaining good habits behind the wheel helps avoid trouble

- Choose usage-based or pay-per-mile insurance

- Look into cuts for driving safely or clocking fewer miles

- Check your rates again every half year or so

Pros & Cons of Cheap Car Insurance Options by State

Pros

1. Lower Monthly Premiums

Cheap rates let folks handle their bills without stress.

2. Flexibility in Selecting Coverage

Many places let people adjust their car insurance depending on what they can afford – not just for damage but also for protection if they’re at fault.

3. Competitive Market

Some states see lower prices because insurers compete—savings pop up here and there thanks to that race.

4. Ideal for Low-Mileage Drivers

Areas using mileage-based plans let rare drivers keep nearly half their cash. Some places charge per mile, so infrequent users spend way less.

5. Better for High-Risk Drivers

Certain states provide unusual coverage options at fair rates – especially if you’ve had a DUI or prior crashes.

Cons

1. Lower Liability Limits

Cheap plans usually offer just the bare legal minimum—so you might end up underprotected.

2. Higher Deductibles

Small monthly payments might mean big out-of-pocket costs if you crash—could hurt your wallet when you least expect it.

3. Limited Add-On Options

Budget plans often skip add-ons—such as towing help – or swap them for basic coverage instead.

4. Price Fluctuations by ZIP Code

City spots—even in affordable states—can come with steep costs.

5. Risk of Underinsurance

Picking the lowest-cost option might still put your wallet at risk if something big goes wrong.

Conclusion

Finding affordable car insurance per state means knowing how location affects cost, then checking several offers while picking protection that matches your budget. Even if prices are low where you live—or sky-high—clever moves like combining policies, keeping a spotless license, or trying pay-as-you-go plans can slash what you owe.

Finding cheap car insurance works in any state—just use smart tools, question wisely, or keep up with what your policy really needs.

FAQs

1. What’s the easiest way to find the cheapest car insurance in my state?

Begin with checking around four to six estimates on the web. Try comparison platforms or reach out to nearby brokers – sometimes they show deals you’d overlook. Apps from insurance companies can help too, offering hidden cuts now and then.

2. Which states offer the lowest car insurance rates?

Usually, places like Maine, Idaho, or Ohio have cheaper rates—thanks to fewer people living there plus better driving safety. Vermont and Wisconsin? Same story.

3. Why are some states more expensive for car insurance?

Fewer crashes, crowded cities, strict rules, or icy roads push prices up in places such as Florida, Louisiana, and Michigan.

4. Can I get cheap insurance even if I have a bad driving record?

Yep. Lots of insurance providers have specific plans for risky drivers. Fixing up your history while taking defensive driving classes might lower payments.

5. Are state minimum coverage policies enough?

They follow the law yet might fall short if a big crash happens. Try boosting your coverage for extra safety.