Cancel For Any Reason Insurance: These days, trip plans can fall apart fast—delays at the airport, sudden illness, a crisis at work, protests abroad, or just deciding you’d rather stay home. Enter CFAR coverage. Not your average add-on, this option lets people back out of vacations even if the reason isn’t usually allowed by regular policies.

If you’re after calm, knowing you can ditch your trip without wasting cash, CFAR might be a top move this year. Here’s a clear rundown—built to rank and inform—that breaks down what CFAR does, where it helps, and who should grab it, whether they’ve traveled loads or not.

What Is Cancel For Any Reason Insurance?

Cancel For Any Reason CFAR insurance coverage is an extra you can add through lots of travel insurers. Instead of just covering set cases—say, sickness, storms, or flight shutdowns—it lets folks back out for pretty much anything the regular plan doesn’t mention.

This can include:

- Fear of traveling

- Switching up my trip details

- Family disagreements

- Work-related schedule changes

- Weather concerns

- Financial worries

- Visa delays

- A small shift inside your chest

You’re free from fixed rules when using CFAR. Rather than being locked in, cancellation stays flexible—so you can back out easily while getting back most of what you already paid, even if it was non-refundable.

How CFAR Coverage Works

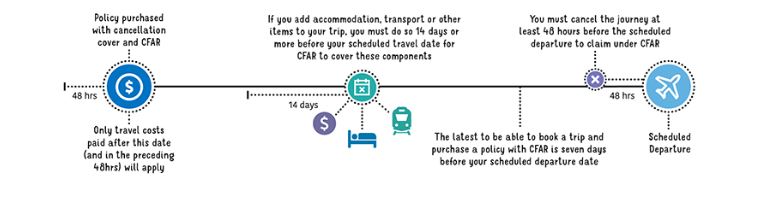

CFAR insurance won’t cover everything, yet it gives back quite a bit—usually around

- Half to three-quarters of what you pay for a trip that can’t be refunded

- You’ve got to cover every bit of what you paid upfront

- Cancellation needs to happen two or three days before leaving

These guidelines let insurers handle uncertainty, yet still offer vacationers more freedom.

Why CFAR Insurance Matters in 2026

More people want options now—life’s full of surprises. Whether storms mess things up, tensions flare overseas, or something comes up at home, this coverage helps cover costs when trips fall apart.

It’s now a go-to improvement for:

- Families with children

- Business travelers

- International travelers

- Cruise passengers

- Honeymooners

- People who want to take costly vacations

If you’ve locked in big trips—say, hotels, tours, cruises, or shows—you’ll want CFAR; it’s a solid safety net. While standard insurance won’t cover cold feet, this one does if plans shift suddenly. Booking ahead can backfire when life changes fast. With CFAR, canceling isn’t a total loss.

Pros and Cons of Cancel-For-Any-Reason (CFAR) Insurance

Pros

1. Maximum cancellation flexibility

Call off your journey due to unexpected issues that most rules ignore.

2. A big chunk of money comes back—between half and three-quarters

Get back most of what you already paid.

3. Keeps you covered when trips go off track

Perfect when you’re booking way ahead, especially if things might change. While plans aren’t set, this option works well. Since details could shift, it gives room to adjust later.

4. Calm confidence when traveling first class

Slashes cash waste on high-end trips while cutting losses for expensive getaways or big-ticket excursions.

5. Perfect for people on the go who never know their plans

Great for workers, moms, dads—anyone facing sudden schedule shifts.

Cons

1. Pricier compared to standard trip coverage

CFAR costs more—adds about 30–50% onto your plan—but gives extra coverage if you need to cancel.

2. Got to buy it soon

Mostly 10 to 21 days after you pay for your first trip part.

3. Money back isn’t the full amount

Most plans pay back just half or a bit more.

4. Strict cancellation window

You’ve got to cancel no later than two or three days ahead of your trip.

5. Available only in select countries or regions.

How easy it is to get coverage depends on the rules where you live.

Who Should Consider CFAR Insurance?

CFAR is especially beneficial for travelers who:

- Thinking about a costly getaway? Maybe one you can’t get your money back on?

- Looking for a way to switch things up without losing money

- Facing health issues, yet juggling work duties, and handling family needs

- Not sure what the weather’s like where you’re headed?

- Need total freedom to feel at ease

If your travel plans mean high costs early on—or things feel shaky—then CFAR might keep you from wasting a ton of cash.

Conclusion

A Cancel For Any Reason (CFAR) insurance plan gives travelers way more control in 2026. Sure, it’s pricier than basic coverage—yet the flexibility beats anything else out there. If you’re booking a faraway getaway, a fancy honeymoon, time on a ship, or heading off for work stuff, this option keeps you covered when surprises pop up. Instead of being stuck, you can back out and still get some money back. It just makes shifting plans feel less risky.

If staying flexible is a priority, or if less stress sounds good, maybe look into CFAR. It could help lower money worries while giving you room to change plans later.

FAQ

1. Is CFAR insurance worth the extra cost?

Yes—if being flexible matters to you. CFAR keeps your money safe where regular coverage falls short, particularly on pricey or uncertain getaways.

2. How much does CFAR insurance reimburse?

Many companies pay back half to three-quarters of upfront, nonrefundable travel expenses when cancellation happens on time.

3. Can I add CFAR to my policy anytime?

No. You typically have to buy CFAR between 10 and 21 days after putting down a payment for your trip.

4. Does CFAR cover last-minute cancellations?

No. Cancel anytime from two to three days ahead—it depends on who you booked with.

5. Are all travel insurance companies offering CFAR?

Some places don’t offer it. Coverage depends on where you are and who covers you. Check with your provider—rules differ.