Bariatric surgery insurance coverage has become one of the most effective long-term treatments for obesity, especially for people who struggle with weight-related health problems such as diabetes, hypertension, heart disease, and sleep apnea. But the biggest question most people ask is, “Does insurance cover bariatric surgery?”

The answer is yes—most insurance companies provide coverage, but the level of coverage depends on your plan, medical necessity, BMI requirements, and state laws.

What Is Bariatric Surgery Insurance Coverage?

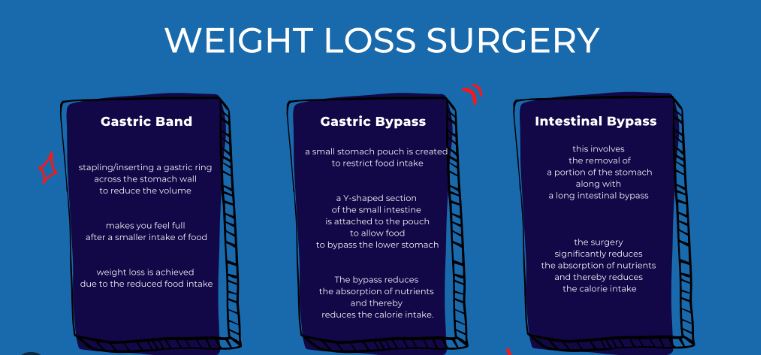

Bariatric surgery insurance coverage shows how much insurers chip in for procedures that help people lose weight, like gastric bypass or sleeve gastrectomy, depending on the plan you’ve got

- Gastric sleeve

- Gastric bypass

- Adjustable gastric band

- Biliopancreatic diversion

- Duodenal switch

Many insurance plans pay for these treatments if doctors confirm they’re needed – your situation’s got to match what your insurer requires.

Eligibility Requirements for Insurance Coverage

Insurance firms often stick to tight rules when greenlighting weight-loss surgery. Typical requirements might mean:

1. A BMI (Body Mass Index) of:

40 or above, otherwise

35+ if you’ve got obesity-linked issues—like diabetes, high blood pressure, PCOS, breathing troubles at night, or heart problems.

2. Evidence showing a treatment is needed

Your doctor needs to show that being overweight is harming your body.

3. A monitored plan to lose weight

Most of the time, you need to try for 3 to 12 months to lose weight with a doctor’s help.

4. Psychological evaluation

To help the patient get what shifts they need post-surgery.

5. Past weight-loss history

Sometimes insurance companies generally demand proof that you tried eating better, moving more, or talking to a counselor.

What Insurance Plans Usually Cover Bariatric Surgery?

Different insurance plans come with varying degrees of protection—some cover more, others less, depending on the policy details

Private Health Insurance

Most big insurance companies—like Aetna or Cigna—cover part or all of it if your doctor says you really need it.

Marketplace (Obamacare) Plans

Coverage changes depending on where you live. However, certain areas require insurance to include weight-loss surgery.

Medicaid

Coverage changes by location. In places such as California or New York, weight-loss surgery might be included if rules are met.

Medicare pays for gastric bypass when BMI rules apply, along with health issues. Gastric sleeve gets covered, provided certain weight and medical factors line up. The duodenal switch is included if both conditions match the guidelines.

Pros & Cons of Bariatric Surgery Insurance Coverage

Pros

1. Lower Financial Burden

Surgery might run from twelve to thirty grand. Yet insurance could slash that price – or pay it all.

2. Access to High-Quality Medical Care

Coverage usually covers labs, also nutrition classes, surgery costs, or check-ins after.

3. Better Long-Term Health Outcomes

Insurance helps folks dealing with obesity get critical operations easier.

4. Coverage for Complications

Many insurance plans pay for problems that come up, extra operations, also check-ups later on.

Cons

1. Strict Eligibility Requirements

If you’re outside the BMI range or lack a medical need, your request might get turned down.

2. Lengthy Approval Process

Doc prep plus sign-off might last from three to a dozen months.

3. Limited Procedure Options

Some insurance plans pay for specific treatments – others don’t include them at all.

4. Out-of-Pocket Costs

You need to pay co-pays, along with deductibles or lab charges.

How to Get Bariatric Surgery Approved by Insurance

1. Start with a Consultation

A bariatric surgeon helps build your medical paperwork so it fits what insurers want – using their guidance to make sure everything’s included.

2. Obtain Medical Documentation

This includes:

- Weight history

- Previous diet/exercise attempts

- Comorbid health conditions

3. Complete a Supervised Weight-Loss Program

Few insurers need this before saying yes.

4. Get a Letter of Medical Necessity

Your doctor needs to give a clear reason.

5. Submit Your Paperwork Early

Getting the green light normally happens within a month to three months.

FAQs

1. Does insurance cover gastric sleeve or gastric bypass surgery?

Yes, most insurance companies cover gastric sleeve and gastric bypass if the patient meets BMI and medical necessity criteria. The coverage varies by plan.

2. How long does it take to get insurance approval for bariatric surgery?

Approval usually takes 1–3 months, depending on documentation, weight-loss trial requirements, and doctor evaluations.

3. Does Medicaid or Medicare cover bariatric surgery?

Yes. Medicare covers gastric sleeve, bypass, and duodenal switch under specific conditions. Medicaid coverage varies by state.

4. What if my insurance denies my bariatric surgery request?

You can file an appeal with medical documentation, new tests, or letters of necessity. Many appeals get approved on the second attempt.

5. How much does bariatric surgery cost without insurance?

Without insurance, it can cost $12,000 to $30,000, depending on the hospital, surgeon, and procedure.

Conclusion

Bariatric surgery insurance coverage might make a big difference, particularly if you’re dealing with obesity or its side effects. Even though signing off takes time and lots of paperwork, the payoff—spending less, feeling better, and steady weight drop—is usually worth it.

If you’re thinking about surgery, begin right away—collect every needed paper while staying in touch with your doctor. When things are organized, plenty of people end up getting their insurance to say yes.