Auto Insurance Rates: For many drivers, car insurance is a necessary cost, but have you ever pondered why vehicle insurance premiums vary so greatly? It’s critical to appreciate the numerous aspects that affect these rates so that you may make informed decisions and perhaps save money on premiums. In this extensive guide, we will dive deep into the realm of auto insurance rates, examining the pivotal factors that shape them and providing valuable insights on how to secure the most favorable rates tailored to your specific needs.

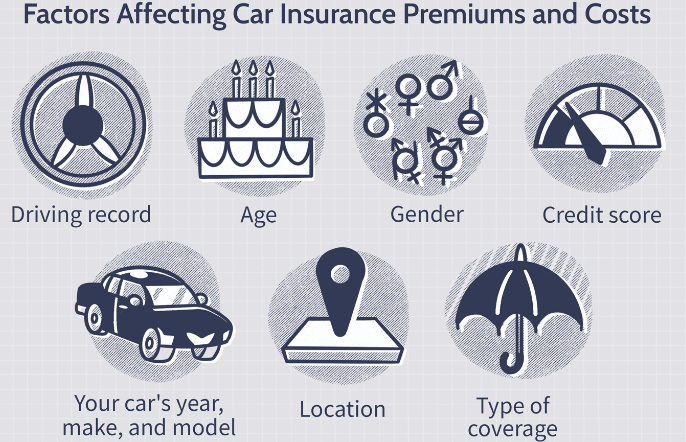

Chapter 1: Determinants of Auto Insurance Rates

1.1. Your Driving History

1.2. Age and Gender

Age and gender also carry weight in determining auto insurance rates. Young, inexperienced drivers and males are statistically considered higher-risk drivers, leading to elevated premiums for these demographics. Nevertheless, as you accumulate experience and age, you may notice a gradual decrease in your rates.

1.3. Vehicle Make and Model

The make and model of your vehicle substantially affect your insurance rates. Sports cars and luxury vehicles often incur higher insurance costs due to their elevated repair and replacement expenses. Conversely, practical and safe vehicles generally come with more affordable insurance premiums.

1.4. Geographical Location

Your geographical location plays a pivotal role as well. Urban areas with heightened traffic congestion and crime rates typically have higher insurance rates compared to rural regions. Additionally, the frequency of severe weather events in your vicinity can also impact your premiums.

1.5. Coverage Level

The extent of coverage you select significantly influences your insurance rates. Opting for comprehensive coverage with low deductibles will result in higher premiums, while basic liability coverage is more cost-effective but offers limited protection.

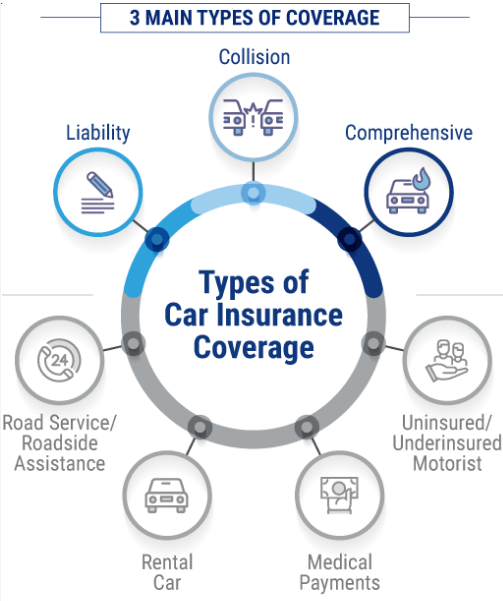

Chapter 2: Types of Auto Insurance

2.1. Liability Insurance

Liability insurance serves as the fundamental form of auto insurance and is often mandated by law. It covers expenses related to damages or injuries sustained by others when you are at fault in an accident. However, it does not extend to cover damage to your own vehicle.

2.2. Collision Insurance

Collision insurance comes into play when your vehicle sustains damage in an accident, regardless of whether you are at fault or not. This type of coverage is especially valuable for newer or pricier automobiles.

2.3. Comprehensive Insurance

Comprehensive insurance offers protection against damage to your vehicle arising from events other than collisions, such as theft, vandalism, or natural disasters.

2.4. Personal Injury Protection (PIP)

PIP insurance covers medical costs and lost wages for both you and your passengers, regardless of fault. It is mandatory in some states and proves invaluable in covering medical expenses following an accident.

Chapter 3: Strategies for Lowering Auto Insurance Rates

3.1. Comparison Shopping

Given the wide variance in insurance rates among companies, it’s essential to engage in comparison shopping. Utilize online tools and consult independent agents to unearth the best rates and coverage options.

3.2. Bundle Policies

Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. This bundling can lead to substantial savings on both fronts.

3.3. Maintain a Strong Credit Score

Your credit score carries weight in determining your insurance rates. A healthy credit history signals financial responsibility and can result in lower premiums.

3.4. Adjust Deductibles

Raising your deductibles for collision and comprehensive coverage can yield lower premiums. Nevertheless, ensure that you can comfortably cover the deductible in case of an accident.

3.5. Safe Driving Practices

Consistently practicing safe driving habits can help preserve a clean driving record and make you eligible for discounts from your insurance provider.

Chapter 4: Discounts and Cost-Saving Opportunities

4.1. Safe Driver Discounts

Numerous insurance companies extend discounts to drivers with a history of safe driving. Completing defensive driving courses can also lead to additional savings.

4.2. Multi-Vehicle Discounts

Insuring multiple vehicles with the same provider often unlocks a multi-vehicle discount.

4.3. Anti-Theft Instruments

Your car’s anti-theft equipment installation may help you pay less for insurance by lowering the danger of theft.

4.4. Good Student Discounts

Students with exemplary academic records frequently qualify for discounts on their auto insurance. Make sure to provide your insurance company with proof of your academic achievements.

Chapter 5: The Importance of Continual Policy Evaluatio

Due to a variety of criteria, including your driving history, the kind of car, and the area, auto insurance prices change over time.

Conclusion

Understanding the complex interactions that determine auto insurance costs gives you the power to choose your coverage in an educated manner.

By engaging in comparison shopping, leveraging discounts, and maintaining a sterling driving record, you can discover avenues to reduce your auto insurance rates and potentially accrue substantial long-term savings. Keep in mind that your insurance needs may evolve with time, underscoring the importance of regular policy evaluations to guarantee that you possess the right coverage at the right price. Armed with the insights gleaned from this guide, you’ll be better equipped to navigate the realm of auto insurance rates and secure optimal protection for both your vehicle and your budget.