Small business insurance is best when starting a small business is thrilling yet uncertain. Small business insurance is your safety net. In this guide, we’ll delve into its importance, types, and smart decision-making for your protection.

The Crucial Role of Small Business Insurance

Safeguarding Your Hard-Earned Investments

Starting a small business demands time, effort, and money. Your investments in equipment, inventory, and space are at risk. Small business insurance is your financial safety net, protecting against accidents, disasters, and theft.

Navigating Legal Requirements

Your business location may have specific insurance requirements. Neglecting them can result in legal issues, fines, or even business closure. Complying with local regulations and obtaining the required insurance is essential.

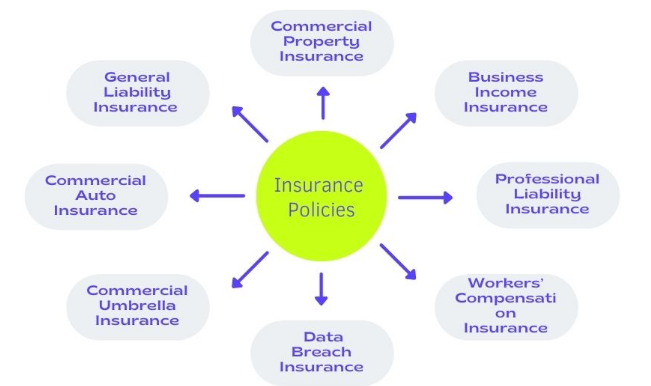

Exploring Different Types of Small Business Insurance

General Liability Insurance

Think of general liability insurance as the foundation of small business coverage. It steps in when someone gets injured on your premises or if your products or services inadvertently cause harm to others. This insurance can also be a financial lifeline when it comes to legal defense during lawsuits.

Safeguarding Your Assets with Property Insurance

Property insurance is a shield for your business assets, covering everything from your physical space to your equipment and inventory. It’s there to help you bounce back financially in the face of property-related disasters like fires, vandalism, or theft.

Protecting Your Team with Workers’ Compensation Insurance

If your business has employees, workers’ compensation insurance is a must. It covers medical expenses and lost wages if an employee gets injured on the job. Moreover, it serves as a vital protection layer for your employees and shields your business from potential legal ramifications.

Professional Liability Insurance

Also known as errors and omissions insurance, this coverage is indispensable for service-based businesses. It provides a safety net against claims of negligence, errors, or omissions in the services you offer.

Navigating Roads with Commercial Auto Insurance

For businesses reliant on vehicles for deliveries or transportation, commercial auto insurance is a necessity. It extends coverage to accidents, damages, and liability tied to your business vehicles.

Home-based business liability insurance

Home-based Business liability insurance, for a long time, the concept of work has experienced a critical change. The rise of the web and changing work environment elements have cleared the way for a surge in home-based businesses. Whether it’s outsourcing, counseling, e-commerce, or providing specialized services, increasingly, people are choosing to run their undertakings from the comfort of their homes. Whereas this drift offers various preferences, it also brings forward a basic thought: home-based trade obligation protections.

Cyber Liability Insurance in the Digital Age

In the digital age, cyberattacks are a rising threat. Cyber liability insurance helps in case of data breaches and cybercrimes, covering expenses for data recovery, legal matters, and protecting your reputation.

Making Informed Insurance Decisions

Assess Your Unique Needs

Selecting the right insurance for your small business begins with a thorough evaluation of your requirements.

Don’t Settle—Shop Around

Resist the temptation to settle for the first insurance policy that crosses your path. It pays to shop around, gather multiple quotes from different providers, and meticulously compare coverage and pricing. This approach helps you pinpoint the most suitable and cost-effective insurance solution.

Regular Reviews for Ongoing Protection

Your business is dynamic, and so are your insurance needs. Regularly review your policies to ensure they remain aligned with your business’s evolving status. Neglecting to update your coverage could leave you exposed to unforeseen risks.

Conclusion

Small business insurance isn’t a choice; it’s a crucial investment in your business’s resilience. It safeguards your investments, keeps you compliant with laws, and ensures security during unexpected challenges.

Insurance can be intricate, but you’re not alone. Get expert advice to customize coverage for your unique business needs. Your small business deserves the protection of comprehensive insurance.

In conclusion, small business insurance serves as a vital safeguard, providing protection for your investments, ensuring legal compliance, and fortifying your business against unexpected challenges. This coverage encompasses a variety of insurance types, including general liability and cyber liability insurance, each customized to suit your specific business needs.

It’s essential to remember that the insurance landscape can be intricate, but you don’t have to navigate it in isolation. Seeking guidance from insurance experts is a smart move, helping you tailor a policy that perfectly matches your unique business requirements. Your small business deserves the peace of mind and resilience that comprehensive insurance can deliver.

FAQ

1. What is small business insurance?

Small business coverage shields your firm if something breaks, someone sues, a worker gets hurt, or unexpected costs pop up.

2. Why do small businesses need insurance?

It protects what you own and keeps things within the law while also offering money safety if surprises or crises hit.

3. What types of insurance should small businesses consider?

General liability is common, also property coverage. Workers’ comp shows up a lot, while pro liability pops in now and then. Business interruption? Seen it before—fits into the mix too.

4. How much does small business insurance cost?

Prices change based on company size, field, where you are, or what kind of protection you pick. Yearly payments usually run anywhere from under $500 to over $3000.

5. Can small business insurance be purchased online?

Yep. Lots of insurance providers give you instant quotes online—so you can check options side by side without hassle. Picking a plan that fits? Fast and simple.