Medigap Plan Comparison: Facing higher medical bills, plenty of Medicare users now pick Medigap to handle extra charges they must pay themselves. These policies cover what regular Medicare doesn’t—like deductibles or coinsurance—that might stack up fast. Yet because there are several options and unclear guidelines, choosing one can seem tricky.

This full breakdown of Medigap options shows what sets common choices apart—such as Plan F, Plan G, or Plan N—helping you pick a Medicare add-on that matches your money situation and medical demands. If it’s your first sign-up or you’re checking what you’ve got now, grasping the contrast between policies lets you go with picks that save cash while covering what matters.

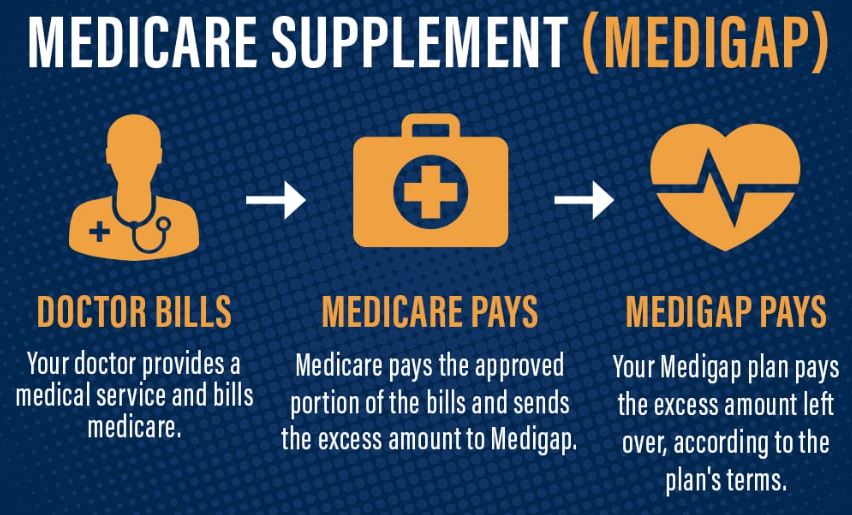

What Is Medigap (Medicare Supplement Insurance)?

Medigap’s a type of personal coverage that runs with standard Medicare—Parts A and B. It chips in for costs you’d usually cover yourself, like copays or deductibles

- Hospital care, along with nursing facility coverage

- Part A and Part B deductibles

- Part B excess charges

- Medical help during trips overseas

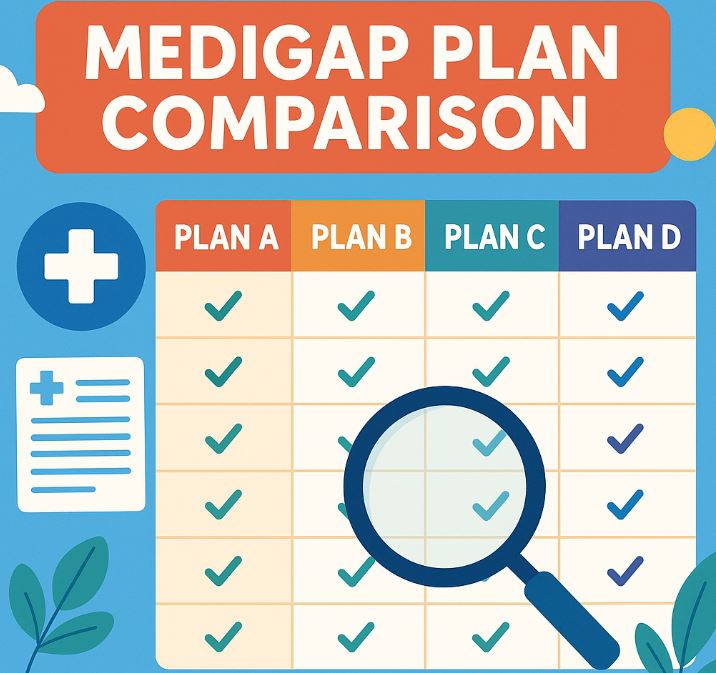

Medigap options come with letter labels—like A, B, D, or G—and they give set perks no matter who’s offering them.

Medigap Plan Comparison: Most Popular Plans for 2026

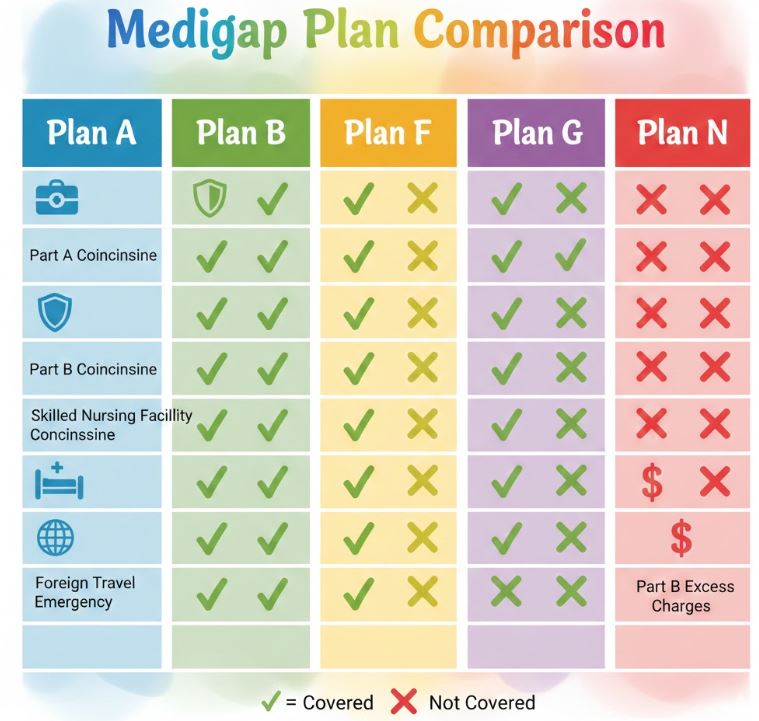

Though lots of Medigap options exist, Plan F, G, or N stand out—thanks to solid benefits and steady pricing you can count on.

1. Medigap Plan F (Most Comprehensive – For Eligible Beneficiaries Only)

Back then, Plan F topped the charts since it paid every dollar for services Medicare allowed.

What Plan F Covers

- Part A deductible

- Part B deductible

- Part A & B coinsurance

- Skilled nursing coinsurance

- Part B excess charges

- Foreign travel emergencies

Keep in mind: you can get Plan F only if you qualified for Medicare earlier than January 1, 2020.

Who It’s Best For

Beneficiaries who want complete protection without paying extra fees.

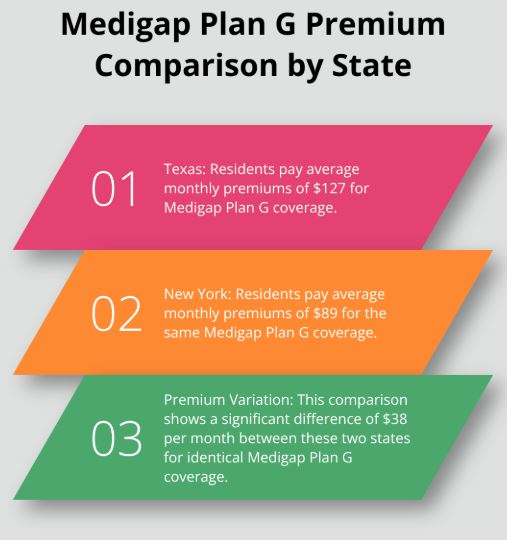

2. Medigap Plan G (Best Overall Value in 2026)

Plan G’s getting top picks lately since it covers almost everything Plan F does—it just skips the Part B deductible.

- What Plan G Covers

- Part A deductible

- Part A & B coinsurance

- Skilled nursing

- Part B excess charges

- Travel help abroad if things go wrong

Once you meet the tiny yearly Part B deductible, Plan G pays all remaining costs in full.

Who It’s Best For

Older folks looking for small monthly payments with steady protection. Yet they care about consistent benefits without surprises each month.

3. Medigap Plan N (Most Affordable Premiums)

Plan N gives solid protection, but you pay part of certain costs.

What Plan N Covers

- Part A deductible

- Hospital costs

- Skilled nursing care

- 80% of foreign travel emergencies

Cost Sharing:

- As much as $20 is due when seeing a doc

- As much as $50 is due when you go to the ER

- Does not cover Part B excess charges

It’s best for people who are fit and want solid protection without paying much each month.

Key Differences: Plan F vs Plan G vs Plan N

| Feature | Plan F | Plan G | Plan N |

| Part B Deductible | ✔ Covered | ✖ Not Covered | ✖ Not Covered |

| Part B Excess Charges | ✔ Covered | ✔ Covered | ✖ Not Covered |

| Office Visit Copays | None | None | Up to $20 |

| ER Copays | None | None | Up to $50 |

| Premium Cost | Highest | Medium | Lowest |

Pros and Cons of Medigap Plans

Pros

Predictable prices when you need healthcare

Covers deductibles—also handles coinsurance; includes copays too

You can pick whatever doctor you want—as long as they take Medicare

Fine when you’re always at the doctor or dealing with ongoing health stuff

Lower financial risk compared to Medicare Advantage

Cons

Monthly payments might cost a lot

Plans skip meds, teeth care, or eye benefits

Plan F isn’t open to people who are signing up now

Some plans require copayments (like Plan N)

How to Choose the Best Medigap Plan

When comparing Medigap plans, consider:

1. Your Health Needs

If you see doctors a lot—or figure bills will pile up—Plan G helps cover the costs.

2. Your Budget

If cutting down what you pay each month matters most, go with Plan N—it’s a solid pick.

3. Provider Choice

All Medigap options let you visit any provider across the country that takes Medicare, while Medicare Advantage doesn’t offer that freedom.

4. Future Costs

Some policies get pricier later on. Look into how steady insurers are before signing up.

Conclusion

Finding different Medigap options helps you pick the best supplement plan for 2026. Plan G gives solid protection without high costs, making it a top choice. For folks in good health who want lower bills, Plan N works well instead. Those who qualify might prefer Plan F since it covers nearly everything.

Knowing the differences helps you pick a Medigap option that works for your body and budget. Spend some moments checking what’s covered, looking at costs from different angles, and then going with the one that matches your care needs now—and later down the road.

FAQs

1. What is the most popular Medigap plan in 2026?

Medigap Plan G stands out because it covers a lot without costing too much.

2. Why is Plan F no longer available to new Medicare beneficiaries?

Plan F got dropped for fresh sign-ups past January 1, 2020—aimed at cutting Medicare expenses down the road.

3. Is Medigap better than Medicare Advantage?

Medigap keeps expenses steady and works across the country, whereas Medicare Advantage tosses in extras such as eye or teeth care. What fits you boils down to personal priorities.

4. Can I switch Medigap plans later?

Right, though insurers might ask about your health—unless you’re protected by guaranteed-issue rules.

5. Does Medigap cover prescriptions?

No—you’ll need a standalone Medicare Part D plan if you want prescription coverage.