No medical exam Life insurance: Life insurance helps keep your loved ones safe, yet plenty skip it due to worries about doctor visits, blood draws, or slow paperwork. Here’s the upside—policies skipping physicals are now spreading fast in 2026. You can gain approval right away, dodge any testing, and sign up through basic web forms. Getting covered this way cuts hassle, skips old-school checkups, and still gives solid protection.

If you’re swamped, hate shots, or deal with medical issues, this rundown shows what’s up with no-exam life insurance—how it runs, top picks, and who gets approved—all broken down easily.

What Is No Medical Exam Life Insurance?

No medical check life cover lets you get approved without a doctor’s visit, needle poke, or pee cup. Rather than tests, companies look at:

- Health questionnaires

- Prescription history

- Driving records

- Medical database checks

- Lifestyle information

This means quicker sign-off – sometimes just a few minutes. Though pricier than standard plans, these options bring serious ease plus reach to countless users.

Who Should Choose No Medical Exam Life Insurance?

This kind of protection works best for:

- Working folks needing a fast sign-off

- Folks who aren’t into doctor visits or shots

- Individuals dealing with minor or mid-level medical concerns

- People who smoke or are overweight might get looked at more closely

- Older folks wanting quick, no-fuss insurance

- People who want a quick sign-off on loans, deals at work, or keeping loved ones safe

If you’re after protection but don’t feel like dealing with doctor visits or exams, this one’s your move.

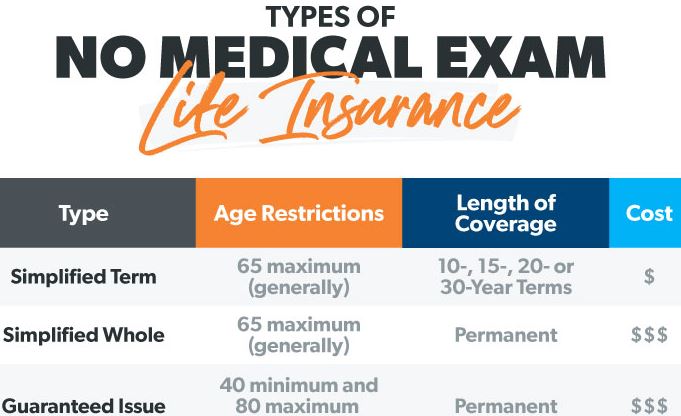

Types of No Medical Exam Life Insurance Policies

1. Simplified Issue Life Insurance

Need to fill out a quick health form—no checkup needed. Gives an okay level of protection.

2. Guaranteed Issue Life Insurance

No test needed, no medical check, no rejections—so it’s open even if you’re older or have health issues. Still, protection tends to be on the lower side.

3. Accelerated Underwriting Term Life

Leans on code, records, or info to greenlight fit folks fast – sometimes at solid rates.

4. Final Expense Life Insurance

A common choice among older adults who want modest yet secure help with end-of-life expenses—using straightforward plans that cover burial or funeral needs without surprise gaps.

How No-Exam Life Insurance Works

Step 1: Application

Complete an online form with basic details such as age, weight, lifestyle, and medical history.

Step 2: Data Check

The insurer reviews prescription records, driving reports, and health databases.

Step 3: Instant Decision

Most applicants receive same-day approval, sometimes within 15 minutes.

Step 4: Policy Activation

Once approved, coverage begins immediately after your first payment.

Pros and Cons of No Medical Exam Life Insurance

Pros

1. Fast Approval

Many plans get cleared right away—perfect when you’re up against a tight deadline.

2. No Blood Tests or Exams

Fine choice if you’re not into doctor visits.

3. Simple and Convenient

The whole process finishes online—fast, maybe five minutes tops.

4. Suitable for Moderate Health Conditions

People with conditions like diabetes, high blood pressure, or being slightly overweight may still qualify for coverage.

5. Great for Seniors

Older folks can still get insurance with guaranteed issue—no matter their health problems.

Cons

1. Higher Premiums

No test rules mean higher costs since companies face greater risks.

2. Lower Coverage Limits

Most firms limit protection from $25,000 up to $500,000.

3. Not Always Suitable for Young, Healthy Applicants

Old-school test-driven rules could save you cash.

4. Guaranteed Issue Plans Have Waiting Periods

Many need to wait 2 or 3 years until they get all the perks.

5. Age Restrictions:

No-exam options only accept people aged 18 to 75.

How Much Does No Medical Exam Life Insurance Cost?

Prices change depending on how old you are, your condition, how much protection you want, and also what kind of plan you pick. Common cost brackets look like this:

- $15 to $30 each month—good for younger folks who don’t have health issues

- $30–$65/month for middle-aged adults

- $60 to $120 monthly for older adults – coverage you can’t be denied

Though pricier than standard plans, the quick access and ease usually beat out the extra expense.

Tips to Get the Best No-Exam Life Insurance Rates

1. Choose Simplified Issue Instead of Guaranteed Issue

If you say yes to a few simple health checks, your costs drop a lot—so it’s worth doing.

2. Compare Multiple Companies

Rates differ a lot from one insurer to another.

3. Avoid Tobacco Before Applying

Smoking really bumps up costs.

4. Keep Your Records Clean

Driving slips affect cost, while past meds shape rates.

5. Apply Early

The earlier you get it, the lower the cost tends to be.

Conclusion

No medical check life cover stands out as an easy-to-get option these days. Thanks to quick sign-offs, zero blood draws, plus plenty of plan picks, loads of folks lock in protection stress-free. If you’re a working mom, nearing retirement, dealing with health stuff, or just after speed, the no-test route gives straight-up peace of mind.

Look at different plans first, check what each covers, then pick one matching how healthy you are and what you can pay. Use a smart approach so you stay covered even if you never visit a clinic.

FAQ

1. How fast can I get no medical exam life insurance?

Most people get approved fast—sometimes in less than a quarter of an hour.

2. Is no-exam life insurance more expensive?

Yes, though the added price might sting a bit—still, getting things fast and easy usually makes up for it.

3. Can seniors qualify without a medical exam?

Absolutely, sure thing. These plans? They’re made for folks aged 50 to 85—no questions asked.

4. How much coverage can I get with no exam?

Most firms give between 25k and half a mil. But if you’re in good shape, some fast-track options might go as high as one million bucks.

5. What if I have health conditions like diabetes or high blood pressure?

You might still get approved. These easier plans let people in even if they’ve had some health troubles.