Natural Disaster Risk Coverage: Floods, fires, or storms—each hitting harder now—leave homes damaged like never before. The weather acts more wildly than usual, so insurers tweak rules almost every season. Some folks only notice missing protection after disaster strikes. Costs climb fast when rebuilding starts out of nowhere.

Folks need to get a grip on disaster insurance by 2026—particularly if they’re in danger spots. Take places such as California or Colorado, where fires spread fast; meanwhile, along the Gulf Coast, Florida, and parts of Texas face fierce hurricanes. A solid plan isn’t just smart—it shields your house when storms hit hard.

This detailed walkthrough breaks down wildfire and hurricane insurance—what you’re really covered for—plus steps to check if your plan fits current weather threats. Packed with tweaks to boost visibility on Google, YouTube, and Instagram.

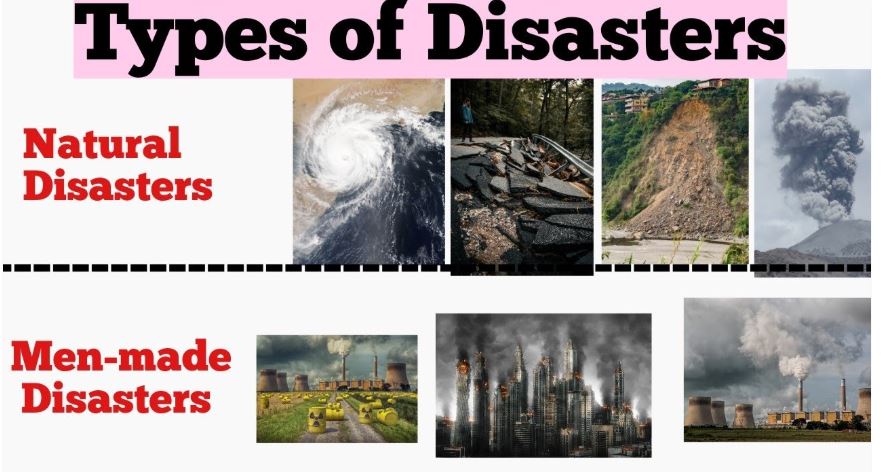

What Is Natural Disaster Risk Coverage?

Natural disaster insurance—also known as catastrophe coverage—protects you when severe weather hits, like:

- Wildfires

- Hurricanes

- Tropical storms

- Windstorms

- Smoke damage

- Storm surges

- Debris removal

Other issues, such as mold or leaking water, A typical home insurance plan offers basic safeguards—but in risky areas, it might not cover everything. Some folks only find out when trouble hits, leaving them unprepared.

Wildfire Coverage Explained

Fire insurance usually covers the house and stuff when burned, smoked up, or covered in soot. By 2026, big companies raised prices—or just left risky areas—because paying out claims got way too expensive.

Wildfire coverage usually includes:

1. Dwelling Coverage

Pays to fix or reconstruct your place when hit by flames or soot.

2. Personal Property Coverage

Covers items like gadgets, clothes, and sofas—anything hit by soot or fire. Takes care of personal stuff damaged when things get burned. Protects your gear if smoke passes through it. Includes anything you own that’s harmed by heat or ash.

3. Additional Living Expenses (ALE)

Covers short-term shelter when fire makes your house unsafe. Uses alternate places to stay till repairs finish.

4. Fire Mitigation Discounts

Many insurers now offer discounts for:

- Fire-resistant roofing

- Ember-resistant vents

- Clearing vegetation

Fitting sprinklers or putting in fire extinguishing setups.

Hurricane Coverage Explained

Hurricane protection gets tricky since destruction arrives through different ways—gusts, loose objects tossed by wind, seawater rushing inland, or heavy rains soaking everything. Most home policies handle guest-related harm, yet water overflow from rain isn’t included; that’s covered only if you’ve got extra flood coverage.

Hurricane coverage typically includes:

1. Windstorm Coverage

Fixes storm-damaged roofs and cracked panes – also handles shifts in framing.

2. Hurricane Deductibles

Several states use portion-based deductibles – around 2 to 5 percent of a house’s worth – when hurricanes hit.

3. Flood Insurance (Separate Policy)

Fits areas hit by hurricanes or near coasts.

4. Roof & Impact Protection Discounts

People who own homes could pay less on insurance when certain features are part of the house

- Impact-resistant shingles

- Hurricane shutters

- Reinforced windows

- Wind-resistant roofing systems

Why Natural Disaster Coverage Matters in 2026

Weather records reveal more frequent catastrophes, also stronger ones. So, it’s getting worse

- Higher insurance premiums

- Fewer insurance options in danger zones

- Stricter underwriting requirements

- More homeowners need supplemental wildfire or hurricane coverage

Staying fully protected means one unexpected event won’t wreck your budget.

Pros and Cons of Natural Disaster Risk Coverage

Pros

- Full coverage if fire, storm, or heavy winds hit—also includes harm from smoke

- Funds stay safe when storms hit unexpectedly

- Coverage includes short-term lodging and removing wreckage, also repairs after damage

- Saving chances when you set up safety upgrades

- Stay calm when things get shaky out there

Cons

- Fewer payouts where fires or storms hit often

- High hurricane deductibles—could be a few grand

- Few insurers offer coverage, particularly across California or near shorelines

- Get flood coverage on its own for complete storm safety

- Tougher rules for checking houses—also keeping them up to date

·

Conclusion

Homeowners need disaster coverage in 2026, mainly because wildfires are getting worse or storms are hitting harder. Knowing which events your plan includes—or skips—might save you money instead of leaving you stuck. Go over your policy now and then check add-ons while thinking about extra help like flood plans.

When wildfire season hits—or even hurricane time—getting solid coverage today means your house and loved ones stay protected, especially as weather gets harder to predict.

FAQ

1. Do homeowners’ insurance policies cover wildfires?

Yep. Many plans include fire-related destruction—like soot or residue—but houses in danger areas might need specific coverage instead.

2. Does home insurance cover hurricane damage?

Just partly. Wind’s included, though water from floods isn’t, so you’d need another plan just for that.

3. Why are disaster-related premiums increasing?

Rising wildfires, more powerful hurricanes top of inflation are pushing up claim expenses, so insurers are hiking premiums across the country.

4. How can homeowners lower natural disaster insurance costs?

Put in fireproof stuff, and get a roof that handles impacts well—also boost your home’s safety now. Check prices from different insurance folks every year instead.

5. Should I buy flood insurance if I already have hurricane coverage?

Right. Strong winds from hurricanes can wreck things; however, rising water and floods mean you’ll need extra coverage just for that—otherwise, costs come straight from your wallet.