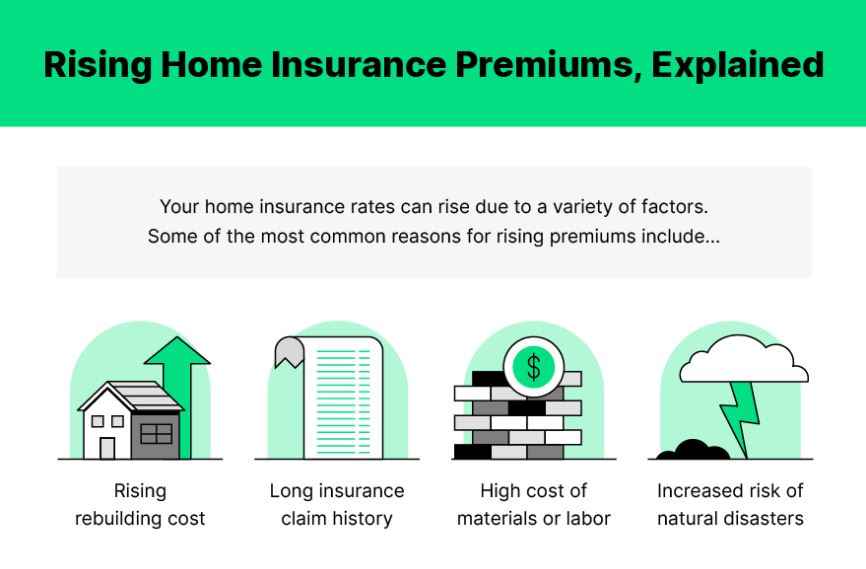

Home insurance premium increases: Nationwide, people are seeing bigger bills for house coverage this year. Thanks to climbing prices and worsening storms, companies now charge more—pushing rates higher than before. If you’re updating your plan or getting a fresh property, knowing what’s driving up fees—and ways to cut them—can guide better choices.

This full walkthrough breaks down what’s driving up home insurance costs in 2026, shares real ways to cut your bills, and gives clear replies to frequent homeowner queries found online. Every part is tuned to show up better on Google, YouTube, or Instagram.

Why Home Insurance Premiums Are Increasing in 2026

1. Climate Change & Extreme Weather Events

The main reason prices increase? More disasters like fires, huge winds, heavy rains, twisters, or icy conditions. Because companies cover way more losses now, they’re changing costs across the board—including places thought to be safer.

2. Inflation & Rising Reconstruction Costs

Construction supplies, workers’ pay, and delivery expenses keep climbing through 2026.

3. Increased Climate Frequency & Severity

Extra claims, especially pricey ones, push insurance companies to stay strong money-wise. Flood issues, roof repairs, or legal troubles add up – leading to steeper premiums.

4. Reinsurance Rate Hikes

Reinsurance—basically insurance for insurers—is getting pricier. When carriers spend extra on protection, they shift the bill to people with homes.

5. Regional Market Withdrawals

Some insurance companies quit offering plans in risky spots such as Florida, as well as parts of California. With fewer firms around, prices go up for those still covered—especially in areas like Louisiana or Texas.

How Homeowners Can Lower Their Home Insurance Premiums in 2026

Despite higher prices, keeping expenses in check is doable—use smarter choices instead of overspending. When things cost more, planning helps stretch every dollar further without cutting corners

1. Bundle Home & Auto Insurance

Pairing plans might cut costs by 20–30%, based on who covers you.

2. Increase Your Deductible

Raising your deductible—from five hundred to one thousand five hundred bucks—could slash what you pay each month.

3. Install Home Security & Safety Devices

Things like smart alarms or cameras might lower your bill. Water sensors plus strong roofs that handle storms could save you cash, too.

4. Shop Around Annually

Always check prices from 4 or so companies before extending – it changes a lot depending on where you live.

5. Improve Credit Score

Several states let insurers check your credit to set rates. When you’ve got a better score, what happens? You pay less each month.

6. Avoid Small Claims

Filing several claims labels you as riskier to insurers. Cover minor fixes yourself if you can.

Pros and Cons of Rising Home Insurance Premiums in 2026

Pros

- Better coverage accuracy means you’re likely paying extra for a truer estimate of rebuilding your house.

- Firmer insurance outfits: extra income means firms cover upcoming payouts.

- Incentives for disaster-ready homes: people boost safety while cutting costs through rewards.

Cons

- Families now spend more each month—costs are piling up faster than before.

- Fewer insurance options in risky zones—homeowners might have trouble getting protected.

- Larger deductibles mean you pay more upfront—so if you want lower monthly costs, some folks choose this route instead.

Conclusion

Home insurance prices go up in 2026 because of storms, higher living costs, and strain on insurers. Even though fees may climb further, people who own homes can lower bills by checking different offers, boosting property security, and picking bigger deductibles—on top of keeping solid credit scores.

Knowing why rates go up helps you choose wisely when managing money, so you can grab a deal that’s both cheap and covers what you need—without wasting time or cash.

Frequently Asked Questions

1. Why are home insurance premiums rising so fast in 2026?

Fees go up because prices rise, rebuilding gets pricier, and storms hit harder – leading to bigger payouts.

2. Which states are seeing the highest insurance rate hikes?

Folks in places such as Florida, California, Louisiana, Texas, or Colorado are seeing the sharpest jumps—thanks to storms, blazes, and dangerous climate trends.

3. How can I reduce my home insurance premium this year?

Bunch your coverages together, check prices every year instead, tweak the deductible higher, toss in some smart alarms at home while you’re at it, and fix up that credit number slowly.

4. Will home insurance keep getting more expensive after 2026?

Yes, experts figure growth will keep going if weather dangers don’t get worse while building stays pricey.

5. Should I switch my insurance provider to get a lower rate?

Yep. Checking different options makes saving cash pretty straightforward. Each company sees risk in its own way—so you might score a better deal somewhere else.