Teen Driver Insurance Costs: Putting a teenager on your car insurance brings one of the steepest price hikes parents face. Young driver coverage runs way above adult rates – the main reason? Lack of experience, greater chance of crashes, plus no real track record behind the wheel. Today’s roads pack more distractions, so companies tag teens as risk-heavy, bumping up both monthly and yearly bills.

Still, using a solid plan—like sharp discounts, careful driving habits, or picking a better vehicle—can slash what families pay for insurance. This full walkthrough explains teen auto rates clearly, shows ways to cut monthly bills, and also highlights which protections actually count for young drivers.

Why Teen Driver Insurance Is Expensive

Teens usually pay way more—like double or triple—for insurance compared to grown-ups. Mainly because they’re newer drivers, which means a higher risk for companies

- Crashes happen way more often among young drivers—numbers show it clearly. While older folks drive more safely, teens face bigger risks on the roads.

- Lack of driving experience means insurers can’t use records—teens haven’t built any yet.

- Distracted driving’s dangerous—phones or gadgets inside cars make it worse because focus drops fast when eyes leave the road.

- Tons of claims—teens send in way more than older folks because they’re still learning the ropes.

- Car type and how it’s used matter – speed-focused or powerful engines usually mean higher costs. Fast models get charged more because they’re riskier to insure.

Even though it’s expensive, a good insurance policy can shield households from money troubles – while giving moms and dads of young drivers some relief.

How Much Does Teen Driver Insurance Cost?

Families usually spend between $2,000 and $5,000 yearly once a teenager is added to the insurance. Things like driving record or car type affect how much it costs

- Location

- Younger drivers, like 16-year-olds, usually face higher costs compared to those who are 18 or older

- Gender

- Driving history—if you’ve got one

- Top marks mean lower prices—smart learners save cash while they study

- Vehicle safety features

- Multi-policy discounts

Parents might lower expenses if they check prices, drive safely, or pick suitable protection levels.

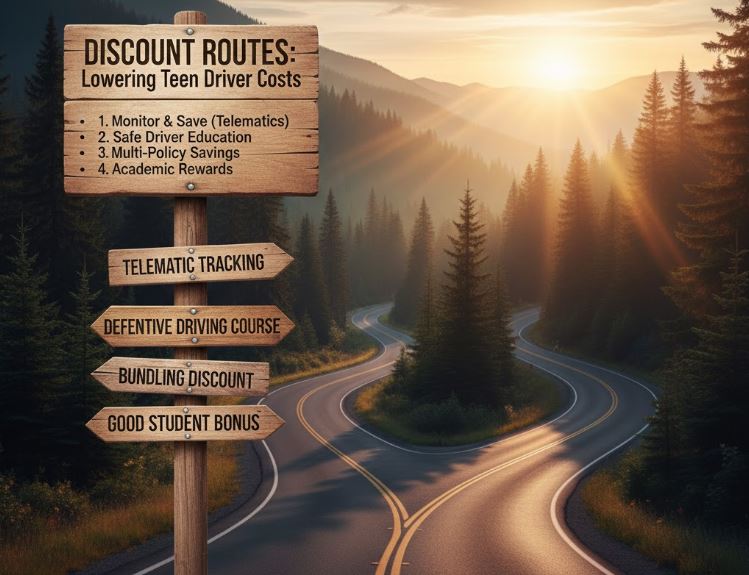

Smart Ways to Lower Teen Driver Insurance Costs

If you want lower payments, try these tested tips:

1. Add Teens to a Parent’s Policy

This costs less compared to buying them their own car insurance plan.

2. Take admission in a Safe-Driving Course

Safe-driving courses usually lead to lower rates.

3. Maintain Good Grades

Many insurance companies give breaks to students with at least a B average—often through special deals if grades stay up. However, it’s not automatic; you usually need to apply.

4. Select Safe, Reliable Cars

Cars that are safe plus cheap to fix usually mean lower insurance bills.

5. Install Telematics or Usage-Based Programs

Insurance companies give perks when you show good behavior via a gadget or phone tool.

6. Limit Mileage

Folks who drive less often pay lower premiums—since they’re on the road fewer miles.

7. Shop Around Every 6–12 Months

Costs shift fast—more so when teens are behind the wheel.

Best Cars for Teen Drivers (Insurance-Friendly)

Picking a good car really affects how much teens pay for insurance. Things like these usually cut the cost:

- High safety ratings

- Good results in collision tests

- Moderate horsepower

- Anti-theft systems

- Affordable repair costs

Toyotas like the Corolla are cheap picks. Or try a Honda Civic—they’re common too. The Subaru Impreza? Solid budget choice. Another option is the Hyundai Elantra—easy on cash. Ford Fusion also shows up a lot.

Pros & Cons of Teen Driver Insurance

Pros

1. Financial Protection for Families

Covers costs for injuries or damaged stuff when a crash happens—also pays if you’re at fault.

2. Access to Safety Discounts

Grades might lower costs for teens, while driving monitors help cut prices; also, safety courses count toward savings.

3. Builds Early Insurance History

Getting insured young means teens can lock in lower prices later.

4. Supports Safe-Driving Education

Folks at home might help young adults build better routines using tracking tools.

5. Flexibility in Coverage Options

Family coverage can be adjusted using liability or full policies, as well as crash-related policies.

Cons

1. High Monthly Premiums

Young drivers are way pricier to cover compared to adults who’ve been behind the wheel longer.

2. Increased Deductibles for Affordability

Folks can bump up their deductible so they pay less on insurance each month.

3. Higher Risk of Claims

Youth drivers crash more often, which could mean higher expenses down the road—so insurers take notice.

4. Limited Carrier Options

Many insurance companies limit protection for teens behind the wheel.

5. Potential for Rate Increases

A single complaint or issue might suddenly push rates way up.

Essential Coverage for Teen Drivers

To keep your teenager safe while saving money, think about:

Needed in many places—pays if you harm someone else’s property or person.

Collision Coverage

Pays when your kid’s car gets wrecked in a crash.

Comprehensive Coverage

Covers theft or vandalism, storm damage, and other issues.

Uninsured/Underinsured Motorist

Crucial for young drivers, for whom crashes often happen.

Roadside Assistance supports young people when things go wrong—like beginners behind the wheel.

Conclusion

Young drivers often mean pricier insurance—yet knowing how to navigate it helps parents save. Tossing them onto a current plan cuts costs, while good driving behavior keeps rates from climbing. Use every discount you qualify for, since that trims the bill quietly. Picking a car built with safety in mind also plays a big role in lowering payments.

Teens need insurance that goes beyond price—safety matters just as much when they’re learning to drive. Plan and check rates now and then so your kid stays covered without breaking the bank.

FAQs

1. Why is teen driver insurance so expensive?

Young drivers crash more often because they’ve barely driven before, so insurers see them as a bigger gamble.

2. Is it cheaper to add a teen driver to a parent’s insurance?

Yep. Tacking them onto a current plan typically costs way less than buying another one on its own.

3. Can teens get discounts on their insurance?

Fine. High marks, safe-driving classes, and less driving, as well as tracking deals, can lower bills.

4. What cars are cheapest for teens to insure?

Sure, solid cars that ace safety tests—take the Toyota Corolla or Honda Civic—tend to cost less to insure.

5. At what age do teen insurance rates drop?

Rates usually start getting better around ages 19 to 21; staying accident-free keeps them going down.